Can Venus (XVS) Reach $1000?

September 11, 2021

Venus is one of the most exciting crypto projects on the Binance Smart Chain that aims to provide a decentralised marketplace for lenders and borrowers with no fees, no slippage and instant transactions, exciting right?

But can Venus reach $1000?

Let's take a look!

Skip ahead...

What Is Venus?

Venus is essentially a decentralised lending platform with an engineered stablecoin dispatched solely on the Binance Smart Chain (BSC).

The protocol allows users to use their cryptocurrencies to supply liquidity and collateral to the market and gain an annual interest (APY).

At the same time, the borrower pays interest on the amount borrowed.

Furthermore, Venus permits clients to mint VAI stablecoins on request within the app.

VAI tokens are engineered BEP-20 tokens fixed to the worth of one U.S. dollar (USD).

Though XVS tokens are BEP-20-based, they are utilized to manage the Venus protocol and can be utilized to decide on changes to the system.

Who Are the Founders of Venus (XVS)?

The Venus Project was established by the Swipe Project Group. The primary objective of Venus is to accomplish decentralization through local area administration. As a result, there are no pre-mines for the group, designers, or originators, giving XVS holders absolute command over the Venus Protocol's direction.

How Venus (XVS) Tokens Work

Venus (XVS) token is used to manage the direction of the project.

Along these lines, token holders can make suggestions and vote on changes and decisions to the protocol.

Moreover, XVS has various provisions like the consideration of insurance on the stage into the framework.

79% of the XVS supply utilized for the dispersion and adjusting of revenue pay on the platform is saved for conveyance to clients who utilize the platform and will get revenue pay.

Therefore, XVS tokens, which are based on liquidity mining, are distributed among the system, of which 35% are designated for borrowers, 35% for suppliers and 30% for minters of the VAI stablecoin.

What Makes Venus Unique?

Venus' principal strength is its fast and low exchange costs, which are an immediate aftereffect of being built on top of the Binance Smart Chain.

The protocol quickly empowers clients to get to loaning markets for Bitcoin (BTC), XRP Litecoin (LTC), and other cryptographic forms of money to continuously source liquidity because of its fast-paced exchanges.

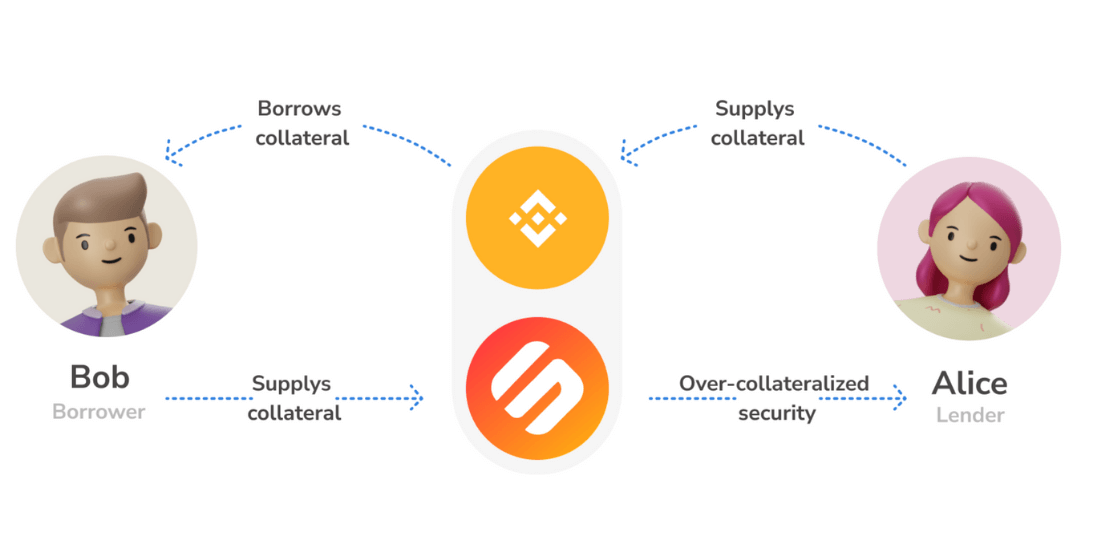

These credits are given from a pool contributed by Venus clients, who get a variable APY for their investment.

These credits are gotten by the over-collateralized stores made by borrowers on the stage.

To avoid 51% attacks, the Venus Protocol uses value feed prophets, including those from Chainlink, to give precise estimating information that can't be altered.

On account of the Binance Smart Chain, the protocol can get to the value at a lower cost and with better productivity, lessening the general expense impression of the framework.

XVS Token Circulation

Venus has a most extreme complete stockpile of 30 million XVS tokens with 11 million tokens currently in circulation.

Venus was one of the fundamental platforms to lead a Launchpool on Binance, which permitted clients to foster XVS by stepping various resources including Binance Coin (BNB), Binance USD (BUSD), and Swipe (SXP) tokens.

An aggregate of 20% of the absolute supply (6 million XVS) was distributed to the Binance Launchpool, and the token was recorded not long after on the Binance spot trade stage.

The venture had no pre-sale, and the project holds no tokens, yet 1% of the complete stockpile (300,000 XVS) is held for Binance Smart Chain system rewards.

How Is Venus Secured?

The Venus network is built on the Binance Smart Chain, a blockchain corresponding to the Binance Chain.

BSC is viable with the Ethereum Virtual Machine (EVM) and is fit for running regardless of whether the Binance Chain gets disconnected or experiences issues.

Binance Smart Chain uses a one-of-a-kind transaction validation system known as a proof-of-staked-authority (POSA).

This is basically a hybrid protocol that combines both proof-of-stake (POS) and proof-of-authority (POA).

Past this, Venus providers are secured via programmed liquidation measures, which will automatically sell the guarantee of borrowers if it falls below 75% of their acquired sum.

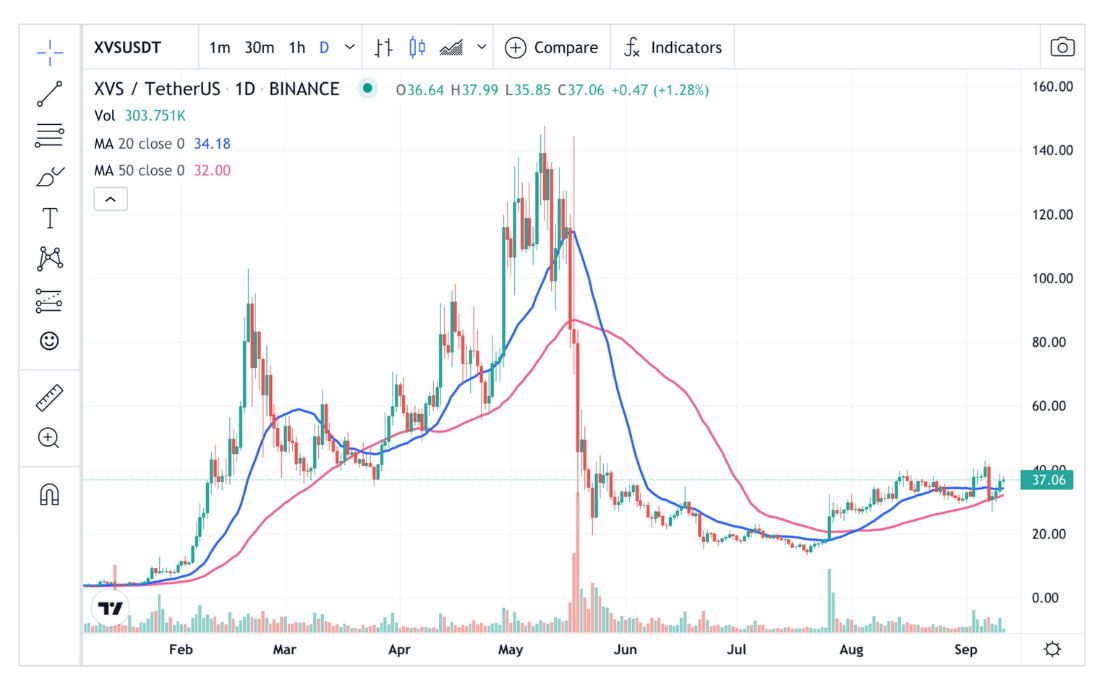

Can Venus (XVS) Reach $1000?

The big question is, can Venus reach $1000?

In short, absolutely.

The Venus Token (XVS) can reach $1000 if it continues on its current path acquiring more users and investors.

Here are a few reasons why Venus can reach $1000:

- It has a very low max supply (30,000,000)

- It's positioned in a booming crypto-lending market

- It has shown an ability to acquire and keep a growing amount of investors and users over the last 11 months.

- It's parented by an already successful project (Swipe)

These are a few reasons why I think Venus has the potential to reach $1000.

However this will be no easy feat, for Venus to reach $1000, it will require a market cap of $30 Billion, which is the current market cap of Dogecoin, the 8th largest cryptocurrency in the world.

But how long will this take?

How Long for Venus (XVS) to Reach $1000?

Based on the projects current growth trajectory, market cap and factoring that the entire supply will be released into circulation over the next 2-3 years and providing the project continues on its current path of success, my estimate is that Venus will reach $1000 by late 2023.

Venus in a Nutshell

Venus is undoubtedly one of the most exciting projects in 2021.

Venus has a bright future ahead, offering an incredible opportunity for lenders, borrowers, and long-term investors alike.