Stablecoins: The Only Guide You'll Ever Need (2021)

You may have heard the term 'Stablecoin' used quite often in the world of crypto, but what are stablecoins?

While, you may have some idea of what the term means, it may still be a bit fuzzy when you try to put an exact definition to it.

That's why we've taken the time to write this stablecoin guide to help clear any confusion you may have had.

Let's get started...

The Introduction of Stablecoins

Since Bitcoin was launched in 2008, it has given us an entirely new perspective on how we transfer value amongst ourselves.

Over the years, the rise of Bitcoin has also led to the introduction of several other cryptocurrencies.

Today, people can use these digital currencies to make global transactions, buy assets, and even make daily transactions at some of the local grocery stores.

All in all, it’s still quite uncommon to find people paying for a cup of coffee at MacDonald’s using cryptocurrency.

That’s because cryptocurrency has been notoriously volatile.

Hence, stablecoins now seem like the only near-ideal way to attempt to find more price-stable cryptocurrencies.

The good thing is that stablecoins are always backed by assets such as gold or the dollar.

In fact, looking at the market trends, stablecoins have been gaining a lot of traction.

They are secure, stable, and low-cost, which is what most crypto users are looking for.

What’s more, stablecoins have been the go-to option for most traders as they often represent real currency such as pounds and dollars.

What are Stablecoins?

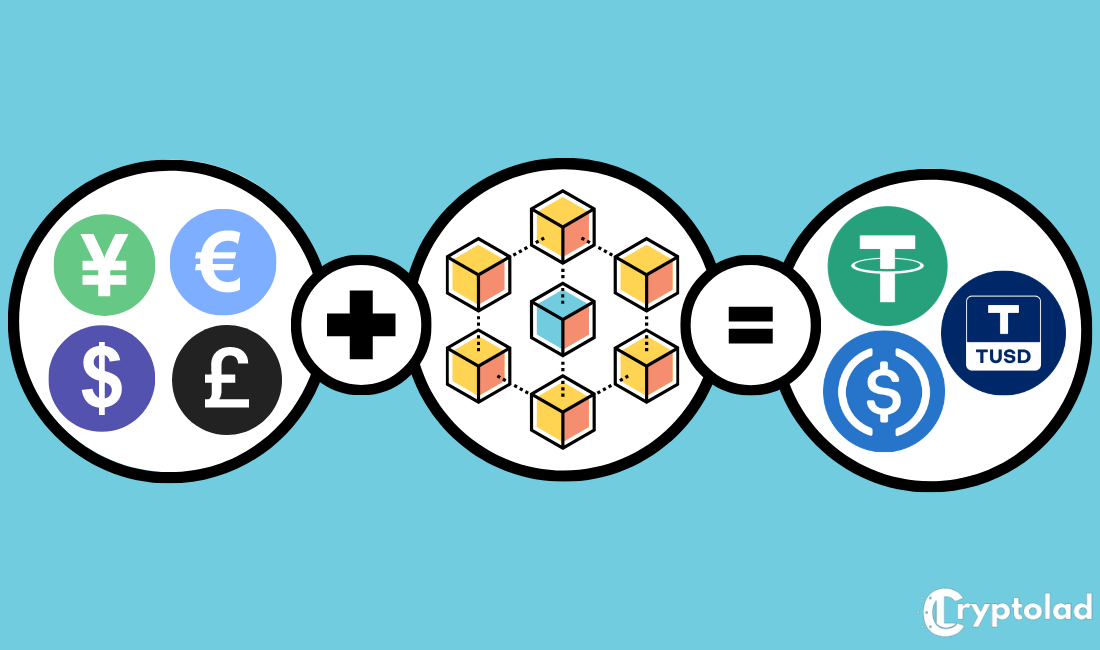

In essence, stablecoins are digital coins linked to assets.

The assets could be either fiat currencies or gold so that they can gain a more stable value.

The best part about stablecoins is that they aim at giving traders the best of both the digital and fiat currencies world.

Some of the benefits of using the stablecoins include;

•Real time transactions

•A high level of security, all thanks to hashing, cryptography, and encryption

•The ability to transfer value in the peer-to-peer transactions

Currently, we have more than 200 officiated stablecoins.

30% of these stablecoins are active, while 60% are still in the R&D stage, while the remaining 10% have been discontinued.

Recently, stablecoins have been gaining traction. The total supply of the stablecoin market has increased to 12 billion.

In fact, in June 2020, the amount of value of stablecoins transferred even exceeded the BTC amount for the first time.

With that said, let’s take a look at the popular stablecoins in the industry.

A List of the Most Popular Stablecoins

• USD Coin

Hands down! The USD Coin is one of the most popular stablecoins launched by the CENTRE consortium, Circle and Coinbase.

The US dollar backs the USD Coin in a 1:1 ratio.

What’s more, USD Coin is based on the Ethereum blockchain that helps you to achieve secure and faster value transfer at an affordable fee.

• Dai

Dai is another common decentralized stablecoin that Maker has developed.

This means that Dai is essentially governed by the community of the Marker token holders.

The ratio of Dai coins to the US dollar is 1:1.

Currently, Dai has been integrated with over 400 apps.

• Tether

Just like the USD coin, Tether is backed by the US dollar.

Tether has a market cap of $10 billion.

Tether stands as not only the biggest but also the first stablecoin in the crypto market.

Tether maintains a ratio of 1:1 with the US dollar in terms of its market value.

• TrueUSD

The TrueUSD is also another stablecoin backed by the US dollar.

TrueUSD has more than $1.8 million in its reserves.

Therefore, most traders refer to TrueUSD as one of the most reliable stablecoins in the market.

• Paxos Standard

The Paxos Standard is also known as Pax. It’s one of the stablecoins that was quickly adopted in the market.

The New York State Department has even approved this coin of Financial Services.

What’s more, Pax has a market value ratio of 1:1 with the US dollar.

However, when you redeem Pax coins for USD, their tokens are destroyed.

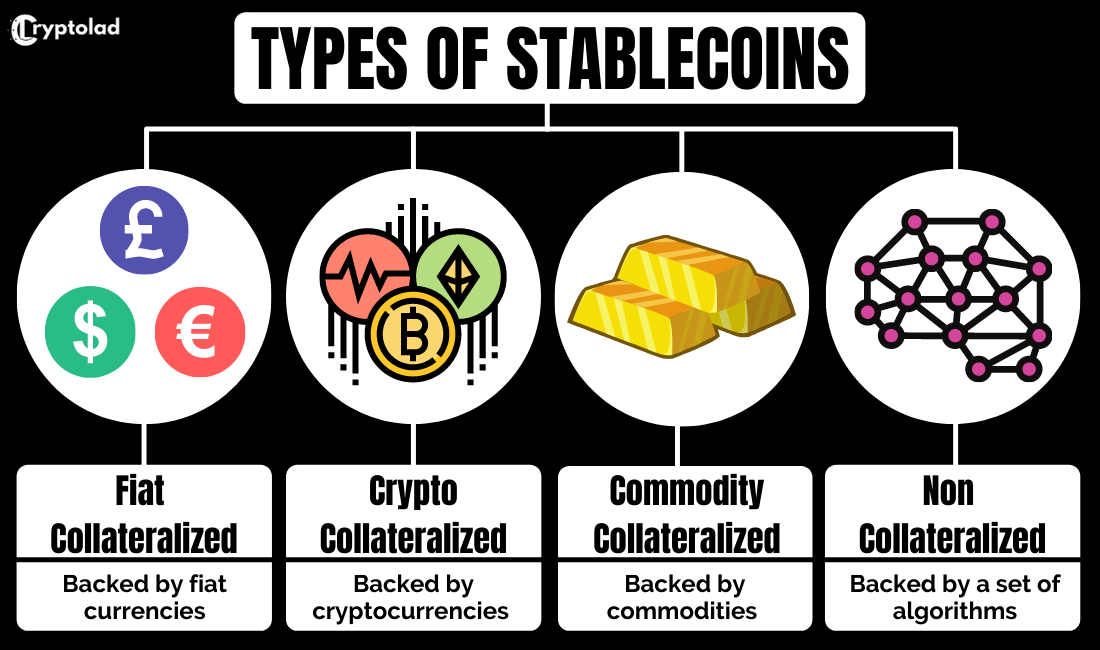

What Are the Different Types of Stablecoins?

Stablecoins are available in four different types.

The varieties are separated with regards to the collateral the stablecoins are backed by.

These include:

1. The Fiat Collateralized Stablecoins

The most common type of stablecoins is fiat collateralized stablecoins.

These are stablecoins backed by fiat currencies like GBP and USD in a 1:1 ratio.

In that, for each of the stablecoin, you get either 1 USD or GBP collateral.

The most common collateralized stablecoins are TrueUSD and Tether.

Pros

![]() Fiat collateralized stablecoins are quite easy to understand.

Fiat collateralized stablecoins are quite easy to understand.

![]() With the 1:1 stability mechanism, you won’t suffer the effects of the high volatility rate of cryptocurrencies.

With the 1:1 stability mechanism, you won’t suffer the effects of the high volatility rate of cryptocurrencies.

![]() The fiat collateralized stablecoins are also less vulnerable to hacks as there is no collateral held on the blockchain.

The fiat collateralized stablecoins are also less vulnerable to hacks as there is no collateral held on the blockchain.

![]() These stablecoins are also highly scalable. In that, the IOS systems have the capacity to grow and support a wider ecosystem.

These stablecoins are also highly scalable. In that, the IOS systems have the capacity to grow and support a wider ecosystem.

![]() If there is even a black swan fallback of the fiat collateralized stablecoins, the central assurance or government can provide the users with a fallback plan.

If there is even a black swan fallback of the fiat collateralized stablecoins, the central assurance or government can provide the users with a fallback plan.

Cons

![]() The fiat collateralized stablecoins expose you to counterparty risks.

The fiat collateralized stablecoins expose you to counterparty risks.

![]() Possible risk of lack of transparency with the fiat collateralized stablecoins; therefore, there is a need for regular audits to ensure transparency.

Possible risk of lack of transparency with the fiat collateralized stablecoins; therefore, there is a need for regular audits to ensure transparency.

![]() The stablecoins also have a centralized issuance and operation.

The stablecoins also have a centralized issuance and operation.

![]() These stablecoins are also highly regulated or beholden to a government or central bank, therefore vulnerable to government interventions.

These stablecoins are also highly regulated or beholden to a government or central bank, therefore vulnerable to government interventions.

![]() When working with the fiat collateralized stablecoins, you will need to trust the independent auditor.

When working with the fiat collateralized stablecoins, you will need to trust the independent auditor.

![]() Finally, the liquidation of the fiat-based cryptocurrencies into fiat tends to be a little bit expensive.

Finally, the liquidation of the fiat-based cryptocurrencies into fiat tends to be a little bit expensive.

2. The Crypto-Collateralized Stablecoins

Just as the name suggests, this kind of cryptocurrency is backed by cryptocurrencies.

The crypto-collateralized stablecoins tend to defy the nature of stablecoins because of the volatile nature of cryptocurrencies.

But the good thing is that with the crypto-collateralized stablecoins, a vast reserve is used to cover the constant price swings.

And that means that the PEG ratio for the stablecoin to the cryptocurrency is not 1:1, as in the case of fiat collateralized coins.

For the crypto-collateralized coins, at least two or three tokens are reserved for every stablecoin.

The popular crypto-collateralized stablecoins are Dai and BitUSD.

Pros

![]() Unlike the fiat-collateralized stablecoins, the crypto-collateralized stablecoins have no counterpart risks.

Unlike the fiat-collateralized stablecoins, the crypto-collateralized stablecoins have no counterpart risks.

![]() The fact that these stablecoins are decentralized, they are resistant to censorship.

The fact that these stablecoins are decentralized, they are resistant to censorship.

![]() The crypto-collateralized stablecoins are the only form of stablecoins that don’t have any systemic risk.

The crypto-collateralized stablecoins are the only form of stablecoins that don’t have any systemic risk.

![]() You can liquidate the Crypto-collateralized stablecoins cheaply and hassle-free into the underlying crypto collateral.

You can liquidate the Crypto-collateralized stablecoins cheaply and hassle-free into the underlying crypto collateral.

![]() With these stablecoins, you don’t have to worry about locality risk or any geopolitical risks.

With these stablecoins, you don’t have to worry about locality risk or any geopolitical risks.

![]() Finally, with the crypto-collateralized stablecoins, you can create leverage that will open you up to an entire supply of money.

Finally, with the crypto-collateralized stablecoins, you can create leverage that will open you up to an entire supply of money.

Cons

![]() In case of a price crash, the stablecoin can be auto-liquidated into the underlying collateral.

In case of a price crash, the stablecoin can be auto-liquidated into the underlying collateral.

![]() The high risk of volatility in the collateral backing of the stablecoin can weaken or destabilize the PEG.

The high risk of volatility in the collateral backing of the stablecoin can weaken or destabilize the PEG.

![]() These stablecoins can only scale if underlying collateral can scale and consistency in all system actors' scale.

These stablecoins can only scale if underlying collateral can scale and consistency in all system actors' scale.

![]() The price in crypto-collateralized stablecoins is less stable than in fiat.

The price in crypto-collateralized stablecoins is less stable than in fiat.

3. The Commodity-collateralized Stablecoins

Commodity-collateralized stablecoins have much in common with fiat-based stablecoins.

Only that commodity-based stablecoins are mostly backed by silver, gold, and other commodities.

Some of the common examples of commodity-collateralized stablecoins are HelloGold and Digix.

Pros

![]() The commodity-collateralized stablecoins give you exposure to assets and that you would have access to. For example, it’s not easy to buy and store a small fraction of a bar of gold. However, with the commodity-collateralized stablecoins like DGX, theoretically, you own a piece of the most-soughed precious metal.

The commodity-collateralized stablecoins give you exposure to assets and that you would have access to. For example, it’s not easy to buy and store a small fraction of a bar of gold. However, with the commodity-collateralized stablecoins like DGX, theoretically, you own a piece of the most-soughed precious metal.

![]() What’s more, when you compare the commodity-collateralized stablecoins with the fiat-backed stablecoins, you will notice that the latter is less susceptible to inflation.

What’s more, when you compare the commodity-collateralized stablecoins with the fiat-backed stablecoins, you will notice that the latter is less susceptible to inflation.

Therefore, they will always hold their PEG more firmly.

In essence, it’s much harder to mine gold or create more real estate than it is for the central bank to mint more money.

Cons

![]() A central party still manages these stablecoins.

A central party still manages these stablecoins.

![]() With the commodity-based stablecoins, there is still a lot of regulatory oversight to ensure there is always enough collateral.

With the commodity-based stablecoins, there is still a lot of regulatory oversight to ensure there is always enough collateral.

![]() With the commodity-collateralized stablecoins, you will need to trust that the central party will do the right thing.

With the commodity-collateralized stablecoins, you will need to trust that the central party will do the right thing.

![]() The commodity-based payment systems tend to be very slow and more inefficient as compared to fiat-backed stablecoins. That means it will take you such a long time to cash out.

The commodity-based payment systems tend to be very slow and more inefficient as compared to fiat-backed stablecoins. That means it will take you such a long time to cash out.

4. Non-collateralized Stablecoins

Although the non-collateralized stablecoins are not backed by any assets, they depend on very complex sets of algorithms.

These algorithms help to sell and buy the stablecoins automatically to maintain the stability of the coins. Popular non-collateralized coins include; Kowala, Carbon, and kUSD.

Pros

![]() There is high-end audibility and transparency with algorithmic stablecoins.

There is high-end audibility and transparency with algorithmic stablecoins.

![]() With the non-collateralized stablecoins, there is absolutely no need for collateral.

With the non-collateralized stablecoins, there is absolutely no need for collateral.

![]() There is a more independent money issuance with the non-collateralized stablecoins.

There is a more independent money issuance with the non-collateralized stablecoins.

![]() This stablecoin essential depends on Schelling points. In that, if just enough people believe that the system will survive, then it’s all it needs.

This stablecoin essential depends on Schelling points. In that, if just enough people believe that the system will survive, then it’s all it needs.

Cons

![]() The algorithmic stablecoins come with some very complex math which makes analysis quite challenging.

The algorithmic stablecoins come with some very complex math which makes analysis quite challenging.

![]() Also, it has a lot of experimental fallback procedures that are barely guaranteed.

Also, it has a lot of experimental fallback procedures that are barely guaranteed.

![]() The stablecoin requires constant growth, or it will have a hard time maintaining the PEG.

The stablecoin requires constant growth, or it will have a hard time maintaining the PEG.

![]() What’s more, with the non-collateralized stablecoins, there is a high peg vulnerability during the flash crashes and bear markets.

What’s more, with the non-collateralized stablecoins, there is a high peg vulnerability during the flash crashes and bear markets.

If there is a selling pressure for an extended period, then the price might drop below what the system can absorb. That may even trigger a death spiral of the stablecoin.

![]() Traders have a hard time trusting the algorithmic stablecoins as they resemble pyramid schemes. What do I mean? A promise of future growth can only strengthen the low coin prices. However, the catch is; the growth can only be subsidized by the new entrants that are buying into the scheme.

Traders have a hard time trusting the algorithmic stablecoins as they resemble pyramid schemes. What do I mean? A promise of future growth can only strengthen the low coin prices. However, the catch is; the growth can only be subsidized by the new entrants that are buying into the scheme.

The Advantages of Stablecoins in Fintech

Stablecoins offer its users and the fintech industry a wide array of benefits.

Some of these benefits include:

•Faster and Cheaper Remittance

Stablecoins essentially offer a quicker, cheaper, and more secure mode of remittance for cross-border payments.

That comes in handy, especially in this currency system that is plagued with not only a slow but also expensive network.

And the fact that stablecoins have price stability, it has more benefits when compared to all cryptocurrencies.

•dApps

The stablecoins can also be integrated with services and applications that allow in-app purchases and payments in the dApps ecosystem.

•Blockchain-based Technology

Another advantage that comes with stablecoins is that they are just like the other cryptocurrencies.

Therefore, they have blockchain-based technology.

That said, stablecoins also bring all the core benefits of the blockchain to the masses.

That includes improved transparency, accountability, and better security.

•Reduced Price Volatility

One of the most popular advantages of stablecoins is eliminating the high price volatility that comes with cryptocurrencies.

That means most of the stablecoins are either backed by fiat currencies or precious metals such as gold and silver.

•Stablecoins Give you the Benefits of Both Worlds

One of the most significant things about stablecoins is that it offers users high security and transaction speed that comes with cryptocurrencies.

What’s more, it also offers the users the simplicity and stability that come with fiat currencies.

Our Thoughts on Stablecoins

As we have seen from this article, stablecoins come in many different shapes and sizes.

The stablecoin market continues to grow rapidly as new entrants try to solve the issues that are facing the tokens currently available in the crypto-market.

The potential of stablecoins is evident - they can help transform the global economy by providing a much steadier medium of exchange that will be suitable for everyday use.

We hope this stablecoin guide helped in clearly answering your question of 'what are stablecoins?'

Happy trading!

PS: We Love Your Comments!

Let us know your thoughts below...