How to Stake Crypto in 2022: The Ultimate Guide

Learn everything there is to know about how to make money staking crypto

Staking has quickly become one of the most popular ways to earn passive income with cryptocurrency...

With APY's reaching up to 100%+ it's not hard to see why.

However, while offering huge rewards, staking is not risk-free...

That's right, staking can be risky business, but in this guide, we'll teach you how to minimise risk and keep your hard-earned crypto safely in your pocket.

So, what exactly is crypto staking and how does it work?

In simple terms, cryptocurrency staking is the process of locking your coins in an account with the promise of earning rewards.

But this process is a little more complicated than that. If you'd like to learn how to stake crypto, you've come to the right place!

Sit back, relax and let us walk you through how to stake crypto in 2022.

What is Cryptocurrency Staking?

Staking is more or less similar to cryptocurrency mining.

However, the beauty of crypto-staking is that it’s a less intense version of earning cryptocurrency. (anyone can do it without much technical knowledge)

In simple terms, crypto-staking is the act of placing your cryptocurrencies in a locked account with the promise of receiving rewards. Typically, you can stake your crypto directly from your crypto-wallet.

Typically, you can stake your crypto directly from your crypto-wallet.

However, you will have to use a cryptocurrency exchange platform to stake your coins in some cases.

Several platforms offer staking contracts, and you can earn a substantial amount through this process.

How Crypto Staking Works

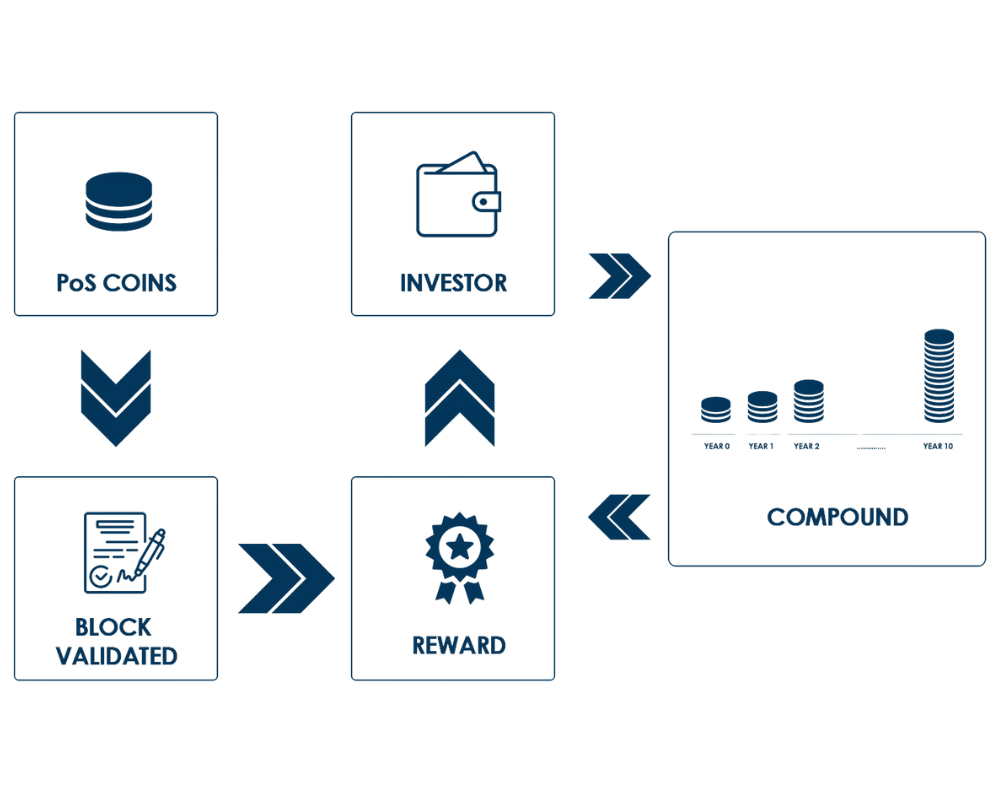

To better understand crypto-staking, you will have to learn how the PoS (Proof of Stake) works.

PoS is a consensus protocol that allows users to efficiently in a decentralized manner.

What is PoS (Proof of Stake)?

I’m sure you’ve heard that bitcoin runs on the PoW (Proof of Work) consensus. That’s a bit different when compared to the PoS (Proof of Stake).

This mechanism allows blocks to be added to the bitcoin blockchain.

In the PoW, miners compete to solve complex mathematical equations, and whoever gets it right faster will earn a block.

Unfortunately, PoW requires a lot of computation to maintain.

The puzzle that the miners compete to solve is only to make sure the system is secure.

With that in mind, most developers couldn’t help but wonder; are there any other security methods that require less computation? And that’s where PoS comes in.

The main idea in PoS is to lock the coins, and a random protocol assigns the right individual to validate the transactions in the blockchain.

Typically, the probability of being chosen increases with the number of coins you’ve staked.

Staking and PoS open up the blockchain to anyone willing to participate in governance and consensus of the system.

More importantly, it’s easy to earn passive income through the staking process.

Best Crypto Staking Platforms

Most cryptocurrency enthusiasts know about Coinbase. It's one of the leading digital assets service companies in the world.

The company was founded back in 2011, and it's been on the rise ever since then. Without a doubt, Coinbase is one of the pioneer cryptocurrency exchange platforms.

The company was founded back in 2011, and it's been on the rise ever since then. Without a doubt, Coinbase is one of the pioneer cryptocurrency exchange platforms.

However, you will incur a 25% staking fee on this site.

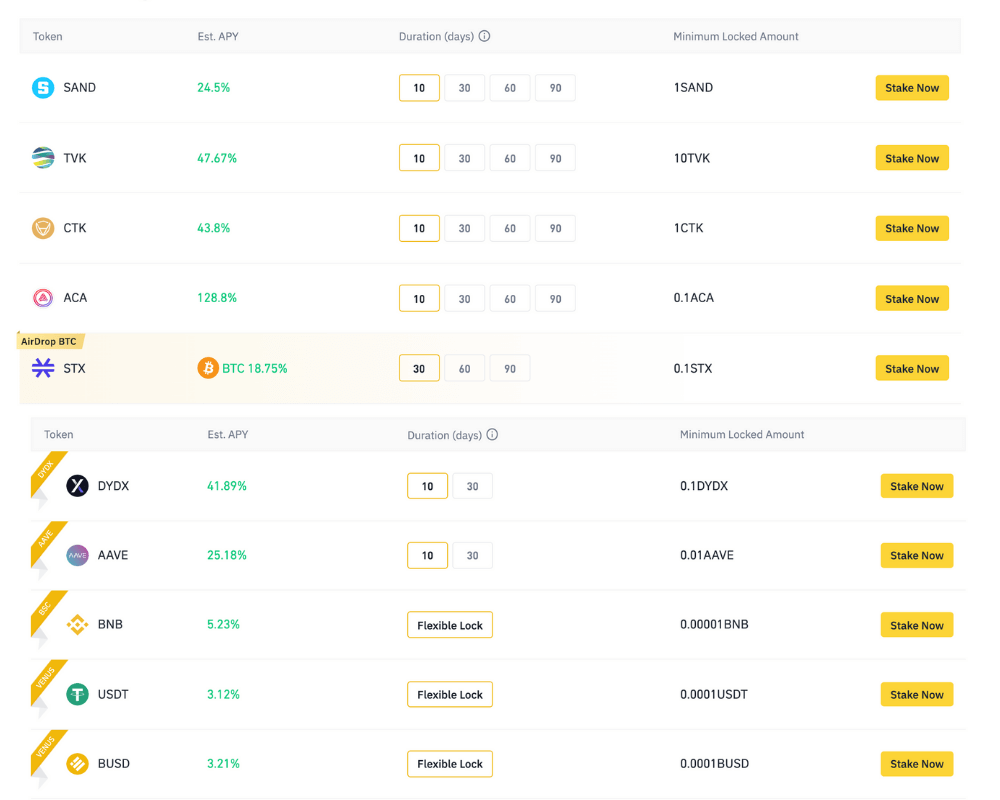

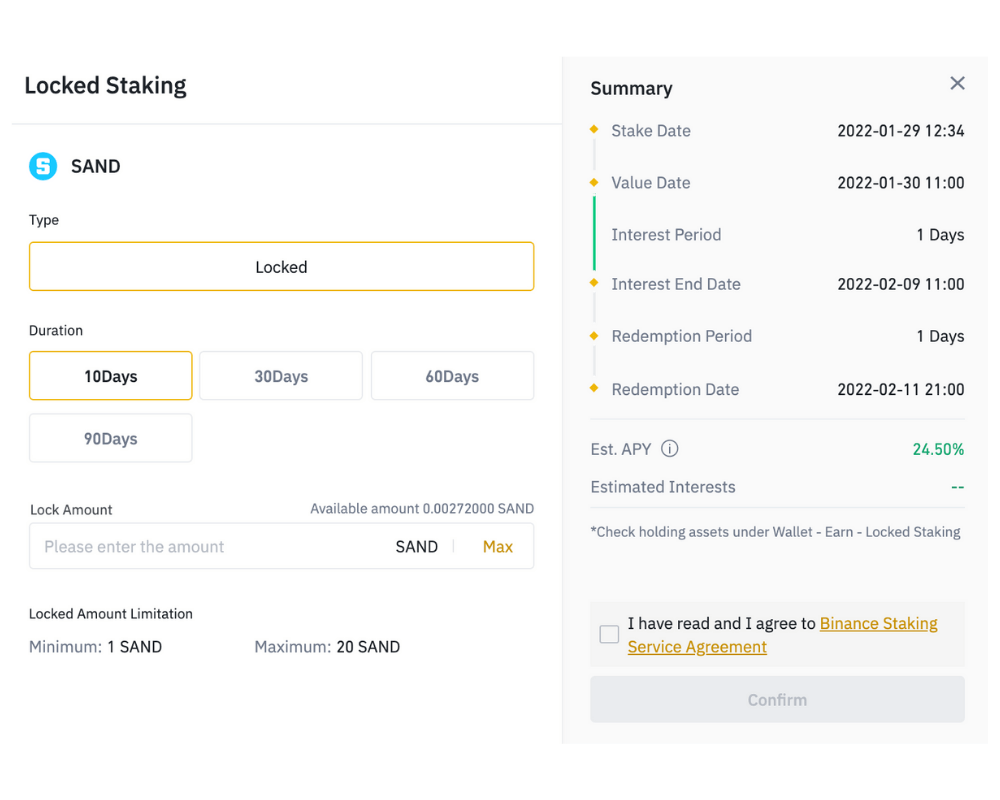

Binance is one of the leading exchanges that provides its clients with futures and margin contracts.

On top of that, you can also stake on the Binance platform. This company was established back in 2017, and it has grown ever since.

Some of the stakeable assets on this platform include Algorand, NEO, Tron, Kava, Stellar, and Stratis. What's more, you won't be subjected to any staking fee on this platform.

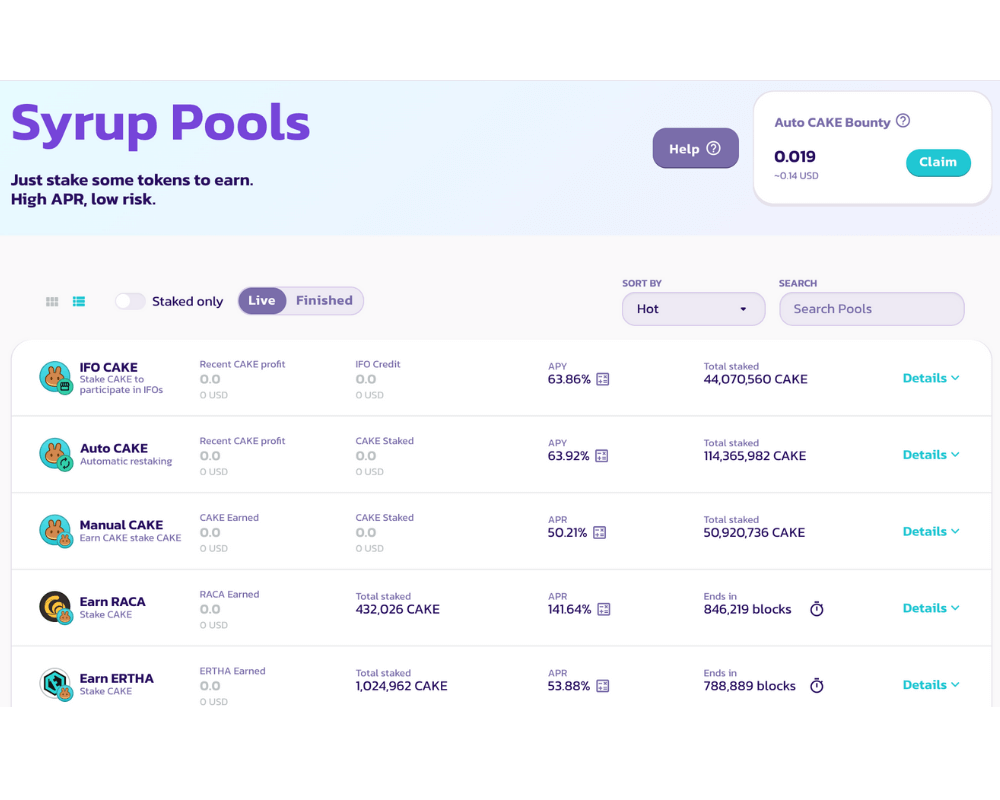

PancakeSwap was one of the most profitable staking platforms of 2021 and continues to see success in Q1 of 2022.

Although growth has slowed this year, you can still earn some serious passive income from this platform.

PancakeSwap is not only a staking platform, it also acts as a decentralised exchange for tokens on the Binance Smart Chain.

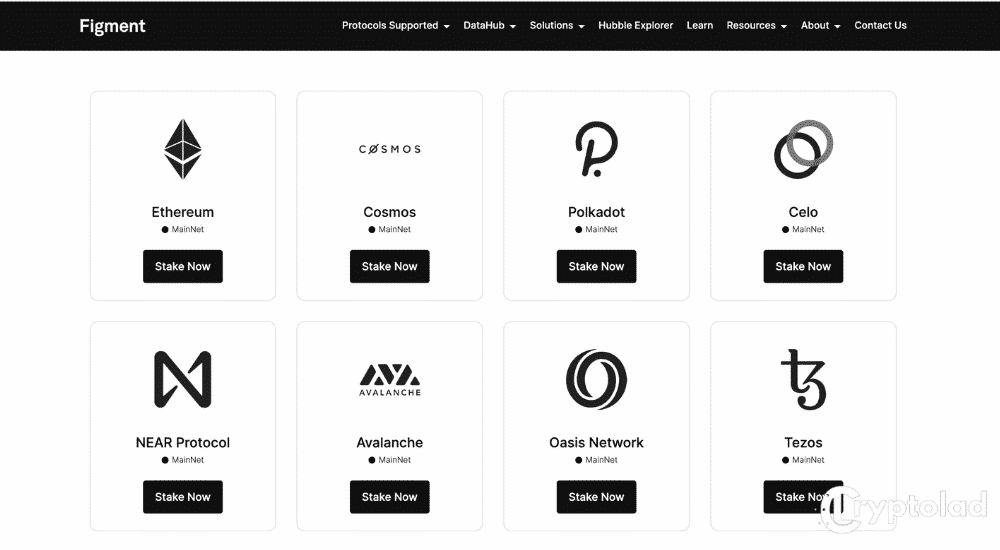

Figment Network is a Canadian-based company that offers cryptocurrency staking services to its clients.

The company has over 3 years of experience in staking, and it's worth checking out.

Some of the coins you could stake on this platform include Ethereum, Cosmos, Polkadot, Celo, Avalanche, Tezos, and Kava.

The company was founded in 2019, and you will get up to a 10% staking fee.

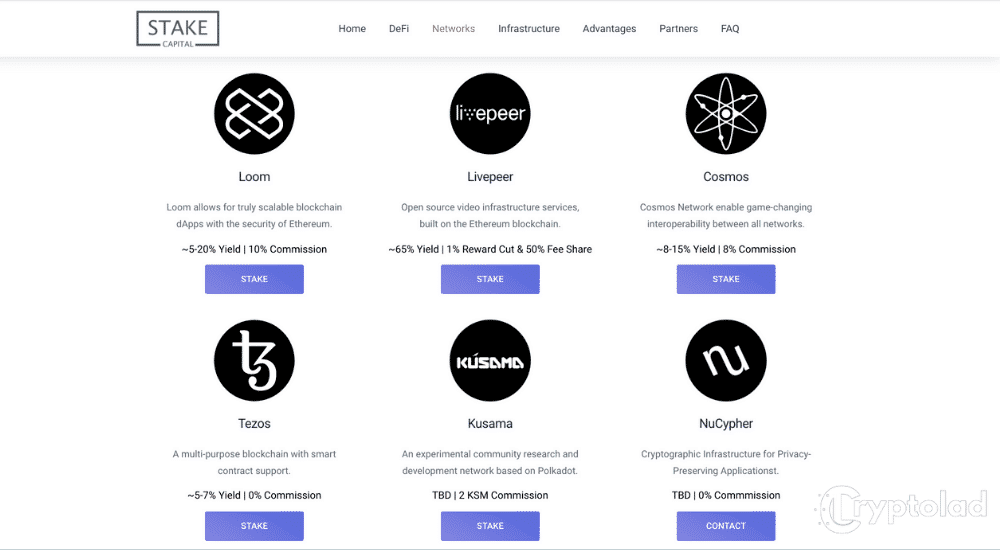

Another company that offers staking services to cryptocurrency enthusiasts is Stake capital.

The company is based in France and also provides financial instruments on top of the staking service.

Coins you can stake on this platform include LOOM, ATOM, LPT, IDEX, and XTZ. Stake Capital was formed in 2019.

With this company, you can get up to 10% staking fees.

Best Cryptocurrencies to Stake in 2022

We can all agree; everyone is looking for financial freedom. But this is not something that you can quickly achieve without multiple streams of income.

That said, if you are looking for ways to earn passive income, you may want to consider crypto-staking. It has become a popular choice for most people.

Essentially, staking involves holding crypto-coins in a trusted wallet then receiving interest as rewards for it.

The proof of stake is the concept that facilitates the crypto-staking of coins. The new blocks on the chains are validated through staking without having to rely on mining.

The more coins you stake, the higher your chances of being chosen as a validator for the block.

These are the best cryptocurrencies to stake in 2022:

•Tezos (XTZ)

Annual ROI: 5-6%

First out on our list is Tezos, which is an infamous blockchain for having one of the most extensive ICO funding campaigns.

Tezos stands out because it has focused on fixing governance issues that other cryptos such as Bitcoin and Ethereum face.

Tezos is one of the few blockchains that can upgrade itself without needing a hard fork like Ethereum and Bitcoin.

Tezos stakeholders can vote for changes on the blockchain. What’s more, stakeholders can take part in staking rewards.

Tezos pays its stakeholders an annual ROI of 6%. And the fact that Tezos implements a unique Proof of Stake consensus known as the Liquid Proof of Stake; means your XTZ is not locked; you can transfer it anytime you’d like.

View their site here for more information

•Tron (TRX)

Annual ROI: 4%

Another popular way to earn passive income is by staking Tron.

Over the years, Tron has shown massive potential with the growth in decentralized apps, purchase of BitTorrent, which is currently one of the most extensive decentralized protocols.

Despite the vast controversies surrounding founder Justin Sun, it’s evident that Tron's influence continues to grow.

Therefore, it would be a great idea to benefit from Tron’s growth by earning passive income.

View their site here for more information

•Fusion (FSN)

Annual ROI: 19%

Fusion is typically a crypto-platform whose main aim is to bring all blockchains together. In that, it provides cross-chain smart contracts, cross-data sources, and even cross-organization.

Essentially, Fusion is an inclusive crypto platform that you can easily connect to by purchasing Fusion coins.

Also, Fusion offers different options for staking. In that, you either can stake with one of the Fusion pools, stake with exchanges, or even running your own node.

View their site here for more information

•Cosmos (ATOM)

Annual ROI: 8%

Cosmos is another top-rated staking coin that has a lot of potentials.

Cosmos aims at becoming the internet of blockchains by connecting the different blockchains in the crypto world.

Cosmos is also based on a Tendermint protocol that enables the different blockchains to communicate with each other.

Tendermint essentially has four modules: the governance module, POS module, fees and rewards module, and the inter-blockchain interaction module. By staking your ATOM tokens, you get rewards of up to 8% annually.

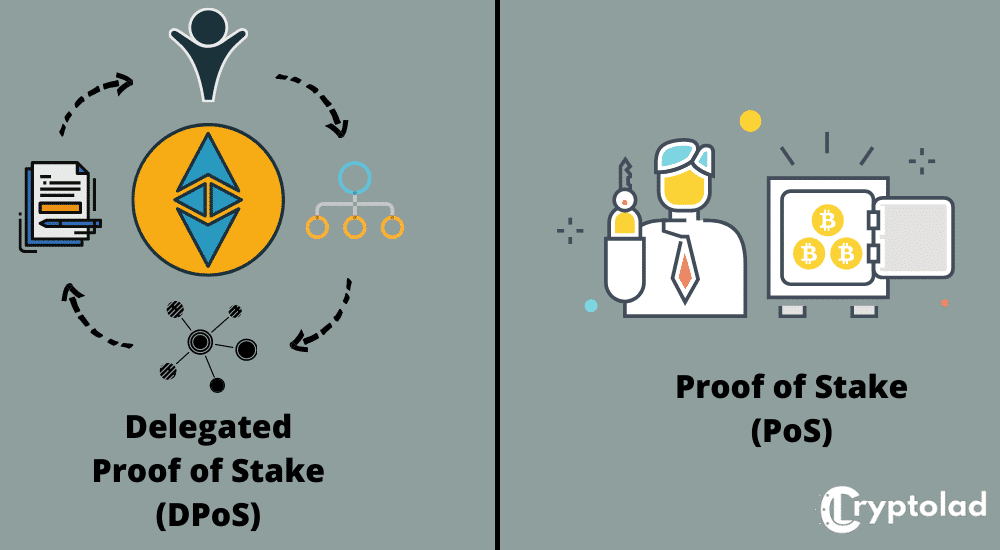

What is DPoS ( Delegated Proof of Stake)?

Delegated Proof of Stake is a consensus algorithm through which users can vote for “delegates.” These users must hold the blockchain’s coin to vote.

The delegates are appointed to make important decisions for the network. These include setting protocols for deciding which transactions hold validity.

The process is fundamentally based on the concept of Proof of Stake.

Here, a person holding a token can partake in a mintage process.

This allows them to select two nodes that validate the block.

They are also rewarded if they can add blocks to the blockchain.

The mechanisms of the two consensus systems are extremely similar. There is one rudimentary difference, though.

In Proof of Stake, every coin holder must contribute to the decision-making process by staking.

On the other hand, only the elected delegates can participate in the Delegated Proof of Stake.

It’s important to understand the basics of blockchain consensus first.

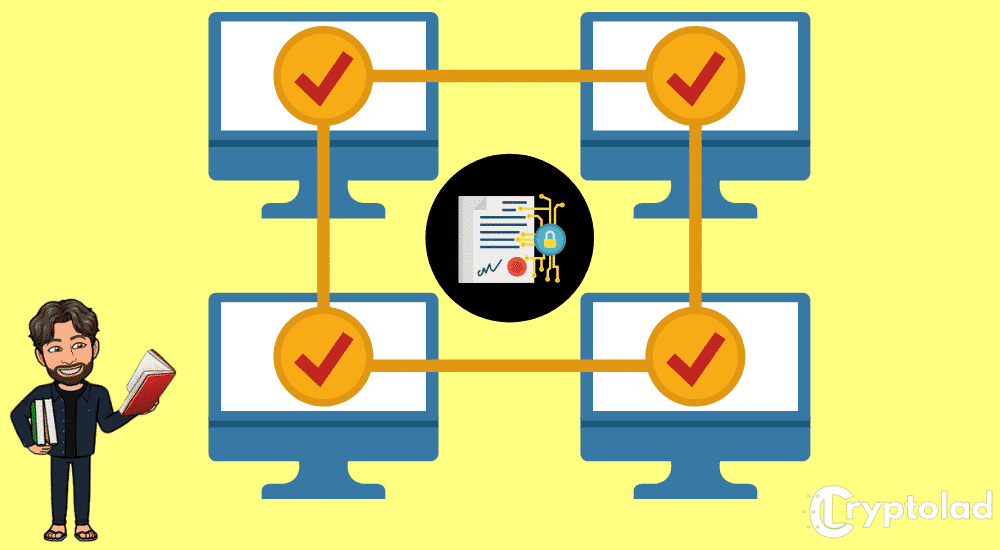

What is the Blockchain Consensus Protocol?

Blockchain networks aren’t centralized. This means that each device in a network verifies a transaction separately.

Because of this, the network must ensure that all nodes are in harmony. They must agree on which transactions are valid or not.

The set of rules that make up an agreement is called “blockchain consensus protocol.”

The Difference Between Proof of Stake (PoS) and Delegated Proof of Stake (DPoS)

Proof of Stake (PoS)

Here, a user must put several cryptocurrency units at stake to verify transactions. They will not be a validator (or forger) otherwise.

The creator of a new block is picked randomly. However, the user’s wealth and coins at stake are taken into consideration.

In this system, blocks are forged rather than mined. This is why forgers receive transaction fees instead.

Forgers must place their coins at stake to create blocks.

If a fraudulent transaction is validated, they lose their holdings and participation rights. This is why this process is safer than most.

Delegated Proof of Stake (DPoS)

This process aims to speed up transactions and block creations.

In this system, users select a group of witnesses along with a governing body.

The smaller number ensures speed and scalability. The top-tier witnesses are compensated for creating blocks and validating transactions.

The elected delegates govern the blockchain with ease. They suggest changes to protocol whenever necessary.

Now, this doesn’t mean the users don’t have a say. The protocol is put into effect only when the users approve it.

Overall, the delegated proof of stake is more efficient as a consensus mechanism.

Online Staking Vs. Offline Staking

PoW relies mostly on the miners and their computation power.

In contrast, PoS validates its blocks through the process of staking.

Online Staking

Like I said earlier, the ‘stakers’ lock their cryptocurrencies in accounts and get rewards.

This allows new blocks to be formed without using specialized mining equipment, for instance, ASICs.

As much as the ASICs require a significant investment from the miner, staking will only need you to invest directly in the blockchain.

Therefore, instead of competing to solve equations, validators are chosen randomly depending on their staked funds.

The stake helps the validators maintain the security of the system. That’s because if they don’t, they risk losing their funds.

Stakers can also add their funds into a staking pool or even leave the coins in their wallets.

Offline Staking

Offline staking or cold staking is a process that involves staking on a crypto wallet, which does not have an active internet connection.

This wallet could be a hardware-based wallet or even a software “air-gapped” wallet with private keys stored on a device that is not online.

This is more like a centralized-finance savings account where you can deposit funds into a particular institution and receive a specific mark-up amount in return for your deposits, depending on how large your funds were.

You can decide whether to be a validator, Super Staker or take part as a delegate to a validator when using offline staking.

If you choose to be a validator, you’ll have to receive delegated stakes using a node’s help from other token bearers.

However, if you’re a delegate to another validator, you’ll have to stake your tokens towards a specific address.

The address is then further delegated to a validator through the staking network using the offline wallet address.

No matter you choose to stake with a Super Staker or a larger pool of stakers, you’ll still earn your commissions deposited directly to your wallet address.

The Difference Between Offline and Online Staking

Online staking revolves around the idea of using a complete node online via an internet connection.

On the other hand, in offline staking, a user can stake cryptocurrencies without using a full node, and the process is non-custodial.

Online wallets are used in online staking, while a cold storage walled or hard wallet can help users stake offline.

Offline staking means that more and more people can get involved in staking because it really doesn’t require much power or resources.

It’s safe, too, and keeps your data protected from cybercrimes, malicious viruses, and bugs.

The Truth About Staking Crypto

While staking crypto won't make you an overnight millionaire, if done properly, it can be a great way to earn a passive income with little to no effort.

Although it still can have its challenges.

One of the most significant drawbacks of staking is that the coin could undergo a wild fluctuating curve, which will jeopardize your investment.

As such, it's always advisable to stake coins that you can afford to lose.

Before you start staking, it's important to research your chosen asset thoroughly, just as you would any other investment.