What are CBDC's & Will They Kill Crypto?

All you need to know about Central Bank Digital Currencies

July 15, 2021

Howdy Howdy!

Today we're going to dive into the world of CBDC's.

I'm going to explain all the fundamentals of Central Bank Digital Currencies and how they affect the world of finance.

So, will CBDC's kill crypto? Let's find out...

Central Bank Digital Currency Definition

A central bank digital currency (CBDC) is a centralized currency issued by a bank. They are also called digital fiat currencies. A CBDC does not use any kind of distributed ledger or blockchain.

Pros:

![]() Completely digital currency

Completely digital currency

Cons:

![]() Centralized

Centralized

What Are CBDC's?

CBDCs are the new-age form of a digital currency issued by central banks that governments worldwide are experimenting with.

CBDCs are governed by a country's monetary authority and executed through a database managed by the central bank, government, or authorized private-sector firms.

Thanks to their unique decentralized structure, cryptocurrencies such as Bitcoin and Ethereum have seen a surge in popularity in recent years.

These two digital currencies run on the blockchain network, which is the heart of the cryptocurrency world.

CBDC is expected to employ the same DLT (distributed ledger) payment system as cryptocurrencies.

CBDCs, unlike cryptos like Bitcoin and Ethereum, will be centralized digital currencies issued and administered by a central bank, a financial institution responsible for regulating the country's commercial banking system and controlling the country's money supply, among other things.

The Future of Digital Currency

Virtual cash is what we would call a double-edged sword, mostly due to its fundamentally transnational attributes.

It shows us a world where efficiency can be gained by tapping into unexplored investment and commercial avenues.

Financial and monetary transactions could be effortlessly boosted by yielding the sheer power of technology.

The transition promises much potential in the section of policies.

However, everything is a mixed blessing. The risks are severe too.

Governments have this continuous struggle with tax evasion, financial data security, money laundering, and possible manipulation in the exchange rates and money supply.

One issue, in particular, has been irking central banks for ages.

There is an unsaid truth that leaving control of monetary policies isn’t a valid option.

Intending to defend their turf alongside preventing tremendous decoupling, central banks have come up with a way to design their very own network of digital payments.

They do so by officially issuing a CBDC or Central Bank Digital Currency.

A general-purpose CBDC is valued as it’s also of a legal tender nature. The payment market might see some innovation and diversity thanks to this.

Designed to maintain safety at all times, these would be a type of universal system allowing you to freely convert into cash at a fixed rate, with a pre-defined policy set out.

Simultaneously, it has to be termed in the local currency, bearing interests on central banks' balance sheets.

What are the Different Forms of CBDCs?'

The Central Bank Digital Currencies are available in two different forms;

1. The Account-based and

2. Digital Tokens

Account-Based CBDC's

The account-based CBDCs are also known as the central bank electronic money, meaning they work just like the regular deposit accounts.

Users need to set up their accounts to perform transactions and transfer money.

Transactions on these account-based CBDCs require verification of the sender and receiver's ID for the transaction to be completed.

Digital Tokens

The token-based system of CBDCs involves transferring an object of value from one wallet to another.

The assets could be a banknote in the traditional financial systems, but things are a bit different with this new age system.

While this digital token will not require verification of identity from the user for transactions to be completed, both the sender and receiver's digital signatures and private and public keys are required.

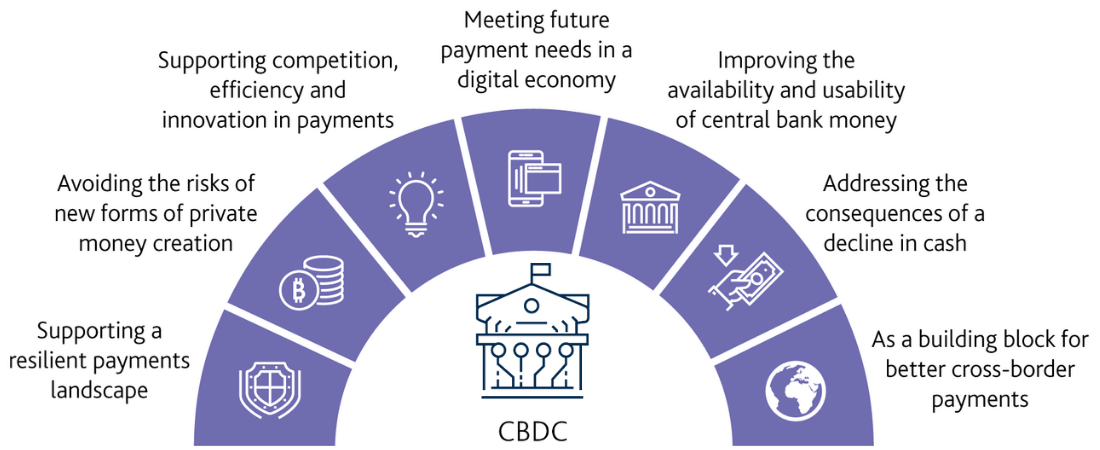

What Are The Purpose of CBDC's?

Although in plans for some time now, a completely operational CBDC is yet to be implemented anywhere, somehow due to technological shortcomings.

Thus, given the shortage of empirical data, estimating the actual cost a transition would bring is difficult.

Calculating the efficacy of financial or monetary policies under those conditions is one more challenge added to the list.

Given all these identified issues, the reviews of CBDC thus far have been mixed.

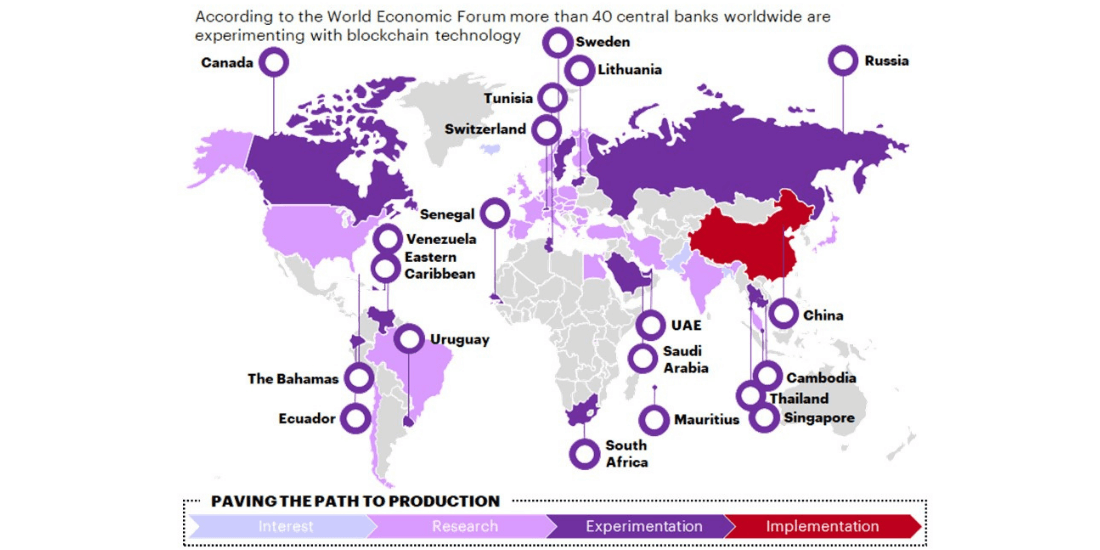

However, it is thought that 4/5 of all central banks are investing in research options to create functioning CBDCs.

The Bank for International Settlements published a report where it was claimed that central bankers across the globe are becoming more optimistic about the future effects of CBDCs.

In all honesty, if private digital currencies dominate the ecosystem, they would probably wipe out legal tender cash.

After all, competition from Google and Tencent in the digital space is extremely intense.

Once large enough, unethical firms can utilize their market influence to take out the competition and ultimately extract more profit.

Usually, this is considered to be against consumer interest.

Governments and central banks have been keeping a close eye on such developments.

This is where we start to under why the CBDC is so desirable from a government’s point of view.

But central banks need to ensure network integrity as their first goal, aside from preventing failures and crashes.

Otherwise, they won’t be able to gain public interest.

Countries like the Netherlands and China have already begun experimenting on a small scale.

It can be said that Sweden will be another addition to the list with its e-krona.

The burning question amidst the cloud of possibilities and danger is: Do CBDCs add meaningful value to the economy?

Why are Countries Pilot Testing CBDCs?

Most countries, if not all, are already trying a pilot study on the effectiveness of CBDCs.

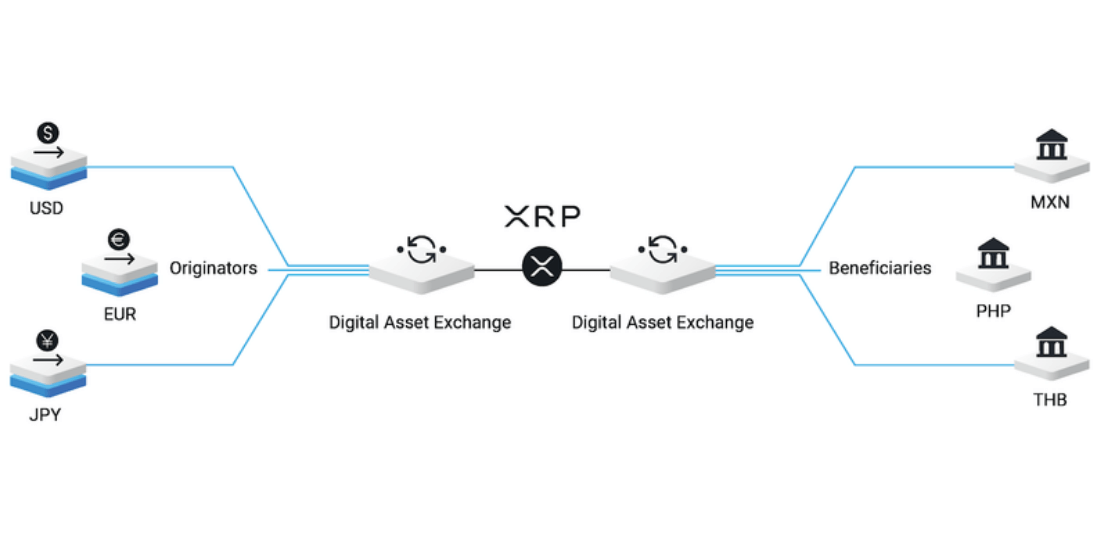

What's more, cryptos like XRP also provide the World Central banks with a framework to create CBDCs on their network.

That means both the crypto and fiat worlds are finding solutions to merge to form a sustainable ecosystem.

But so far, it's still a far-fetched dream that needs a lot of work before full-scale deployment.

Nevertheless, CBDCs carries significant benefits, including:

Reduced cost and increased efficiency

When compared to traditional payment systems, CBDCs theoretically will increase the payment efficiency in any country.

The decentralized blockchain technology could potentially pave the way for gross settlement, which happens in real-time.

That translates to lower fees compared to the international payment system that we currently have.

Increased financial accessibility

Commercial banks are currently holding all the cards as intermediaries.

That leaves many people unable to access financial services, especially individuals without a bank account.

CBDC's will entirely wipe out the challenges that accompany the lack of physical currency, thereby allowing a vast majority of the population access to financial services.

Increased economy

We can all agree central bank digital currency will lead to an increase in the size of the economy.

A significant portion of the GDP in a country is used in the printing of money.

However, CBDCs are digitalized so that money can be used in other productive activities.

Tax evaders crackdown

With a CBDC, the system is fully automated hence avoiding taxes is virtually impossible.

Therefore, when the system is digitized, the government could crack down on all tax evaders and reduce the black market's effects.

Cross-border payments

The most dominating feature of CBDCs is cross-border payments.

Through CBDCs, cross-border payments could happen in minutes, if not seconds.

More importantly, it will also reduce the interest rates associated with such transactions.

With CBDC's, we no longer have to use the US dollar to trade between pairs since the system is designed to simplify cross-border transactions.

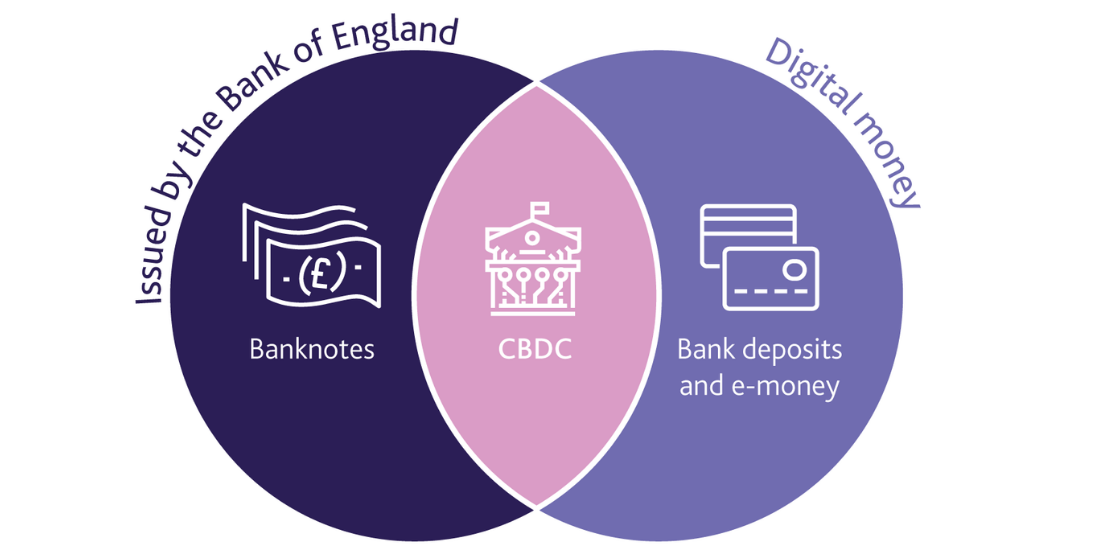

Are CBDC's Cryptocurrencies?

Here's where most people tend to get confused.

As much as CBDCs run on blockchain technology and operate like crypto, they are not cryptocurrencies.

Several features set CBDCs apart from cryptos, and they include:

- Private ledgers: unlike cryptocurrencies, CBDCs run on a blockchain of private ledgers since they are centrally structured. That means the whole blockchain network does not have access to these ledgers, and as such, the transactions are only viewed by the central banks. On the other hand, cryptos operate on an open public blockchain network.

- Zero anonymity: the holy grail of cryptos is the anonymity they carry. The same case doesn't apply when it comes to CBDCs. Users transferring CBDCs will have their identity pegged to the bank account and personal information.

- Central Banks are in charge: when it comes to CBDCs, a specific central bank will be authorized to set the rules. That means every transaction is liable to the central bank's regulations. While on the other hand, crypto rules are typically set by the community.

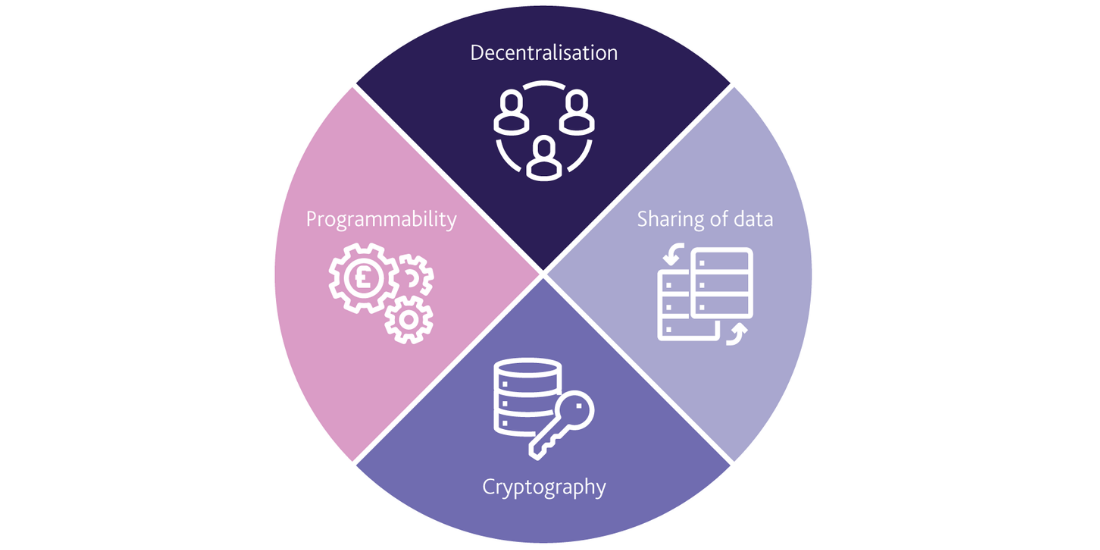

CBDCs and Distributed Ledger Technology

We are already living in a world where most money transactions are digital.

We have all these apps on our smartphones that help us send, receive, and check our balances by pressing buttons and using credit cards to make payments.

So, what's different about CBDCs?

CBDCs are digital, but they have adopted a slightly different kind of technological makeup.

CBDCs are reengineering money from the ground up.

In fact, CBDCs are heavily borrowing from the underlying technology in Bitcoin; the Distributed Ledger Technology.

Banks need a ledger to store the transactions a person has made and their money to keep track of money.

Usually, the traditional banking system has a central database that stores all the financial records of people.

However, with DLT, things are a bit different.

First: the DLT comes with several copies of the transaction history managed by a foreign financial entity. In this case, the country's central bank.

Second: the DLT presents a permissionless blockchain that allows only a few entities to access or alter the blockchain.

XRP and CBDCs

XRP and its parent company Ripple are the champions of CBDCs in the crypto community.

RippleNet is already partnering with the major players in the fiat industry to make their mission come true.

Ripple is creating an ecosystem set to merge the cryptocurrency world with the fiat community.

The company uses XRP to provide liquidity to its partners, which frankly has sparked much criticism from the crypto community.

Additionally, the Securities and Exchange Commission, SEC also filed a lawsuit against the company, claiming they sold unregistered securities.

Regardless, Ripple has already implemented cross-border payment with several banks, including the National Bank of Egypt and LuLu International Exchange.

The partnership elevates the remittance experience into Egypt by encouraging faster and less costly cross-border payments.

To put it simply, Ripple and XRP are at the centre of crypto, CBDCs, and fiat connections.

That makes this coin a worthwhile investment if such an innovative idea pulls through.

Will CBDC's Kill Crypto?

Now, let's get to the most asked question, 'Will CBDCs Kill Crypto?'

When rolling out any currency, adoption is always vital.

With CBDCs, there is a progressively limited supply that makes it hard for them to overtake cryptocurrencies.

CBDCs are aiming at upgrading the payment infrastructure, unlike Bitcoin that attempts to upgrade the money itself.

The problem is that the rise of CBDCs comes with many risks.

For instance, with CBDCs, there is a severe privacy concern as there is a central entity that controls the central ledger that helps monitor the CBDC transactions.

Cryptocurrencies remain a big part of our financial system as they address some of the privacy concerns we face with CBDCs.

For instance, with Bitcoin, you can enjoy complete anonymity with the transactions, which would be impossible to achieve with CBDCs.

Thus, while CBDCs are likely to interfere with the growth of cryptocurrencies, they cannot be a replacement for Ethereum or Bitcoin.

Opportunities and Risks

Central banks could try targeting monetary stimulus more particularly beneficiaries, and assistance can be provided to detected vulnerable sections during economic stress.

Earmarking account top-ups can be done, too, for specific purposes.

But including all these features might bring complications.

It can hurt the ease of access...

Plus, central banks holding such extensive powers may spark controversy among the public, especially if they are under an authoritarian government that can use it to store their transactions to exercise unfair control over the citizens.

Another fear is that if the general mass can convert deposits into CBDC accounts, this might drain out the primary funding source for commercial banks.

Shortage of demand deposits means an exaggerated reliance on pricier alternatives, for example, wholesale funding.

Binance - The worlds largest crypto exchange

Binance has the very best volume out of all cryptocurrency exchanges, additionally, they also offer extremely low trading fees at 0.05%-0.1%. The high volume and liquidity at Binance means you'll be able to be in and out of trades within seconds which is crucial as a crypto trader.

The Truth About CDBC's

With technology being an ever-changing, ever-improving factor in every field, the financial landscape sees rapid changes.

Over the past few years, digital money has been proposed in many sectors to make the turn away from cash smoother, and a few systems are already in the works.

Not only that, but the ongoing pandemic has had some major contributions to the rising usage of digital currency as the rate of online shopping has increased substantially.

It’s safe to say that a technological paradigm shift is underway.

The rise of various forms of cryptocurrencies, blockchains, and mobile payment systems have had two different impacts on the general audience and market: Excitement and Scepticism.

Electronic money piques interest with its disruptive system alongside the distributed ledgers (DLT) system underpinning it.

This was enough to catch the eyes of private financial institutions and central banks alike.

While some are impressed by the decentralized nature and transparency offered by DLTs, the other part of the population quickly dismiss it as a tactic of the idealists out of the banking system to bring the industry under their control.

Even though CBDCs are not technically designed to get rid of cryptocurrencies, they will potentially change the system forever.

Once the pilot testing is over, and these coins finally hit the market, most traders will panic and liquidate their assets. That could result in a significant market crash.

That's because most traders enjoy the anonymity that comes from trading crypto and, sorry to say, the lack of tax compliance.

But frankly, the crypto market has been under a microscope, and most countries are now implementing tax regulations on the market as well.

All we can do is wait and see what happens next.