Pump and Dumps Explained: How to Avoid Them

In this article, I'll explain what a 'pump and dump' is and give you a few tips on how to spot and avoid getting caught In the middle.

Let's get started...

What is a Pump and Dump?

A pump and dump scheme is when individuals or groups of individuals are involved in artificially inflating the price of a security by spreading misleading and false statements or purchasing a large amount of a low-cap security to cause a spike in the market and attract other investors.

This fake inflation is termed as a "pump".

The fraudsters make profits by selling those securities at an elevated price as quickly as possible, and this is termed as the "dump."

While the immoral seller enjoys profits, the new owners are likely going to lose a significant portion of their capital as the price of the security will inevitably plummet after the "dump."

From what can be guessed quite easily from the concept, the pump and dump scheme has been ruled illegal.

Pump and Dump Explained: Basics

Traditionally, pump and dump schemes were completed through cold calls.

However, with the era of technology and the internet taking over, the illegal scheme became widespread at the speed of light.

Perpetrators make online posts to tempt investors to purchase a stock quickly, claiming to hold insider information the share's price will experience an upswing after a particular "development".

As the naïve buyer's run-in, the fraudsters sell off their shares, resulting in a dramatic drop in the share price. The new investors lose their capital.

Modern Day Pump and Dump

By bulk buying stocks that trade on lower volume, the schemer can initiate a price action.

In reaction, the price is pumped up.

The price action is followed by the investors who get motivated to buy heavily, further pumping the share price.

At a certain point, when the schemer decides the stock is going to fall off, they can dump their shares to rake in big profits.

Pump and Dumps in Crypto

For the most part, the scheme revolves around manipulating microcap cryptocurrencies.

Typically, these microcap cryptocurrencies are trading at an extremely low price.

They don't need to follow stringent guidelines required for public listing.

As a result, the information regarding the securities is vulnerable to manipulation by the perpetrators.

Another thing that makes it easier for these fraudsters is the lack of public information.

Potential investors don't have enough information to do a background check on the company.

On top of that, microcap cryptocurrencies are very illiquid as a security with super low trading volume.

Therefore, even the smallest of transactions can have a significant impact on the price of the security.

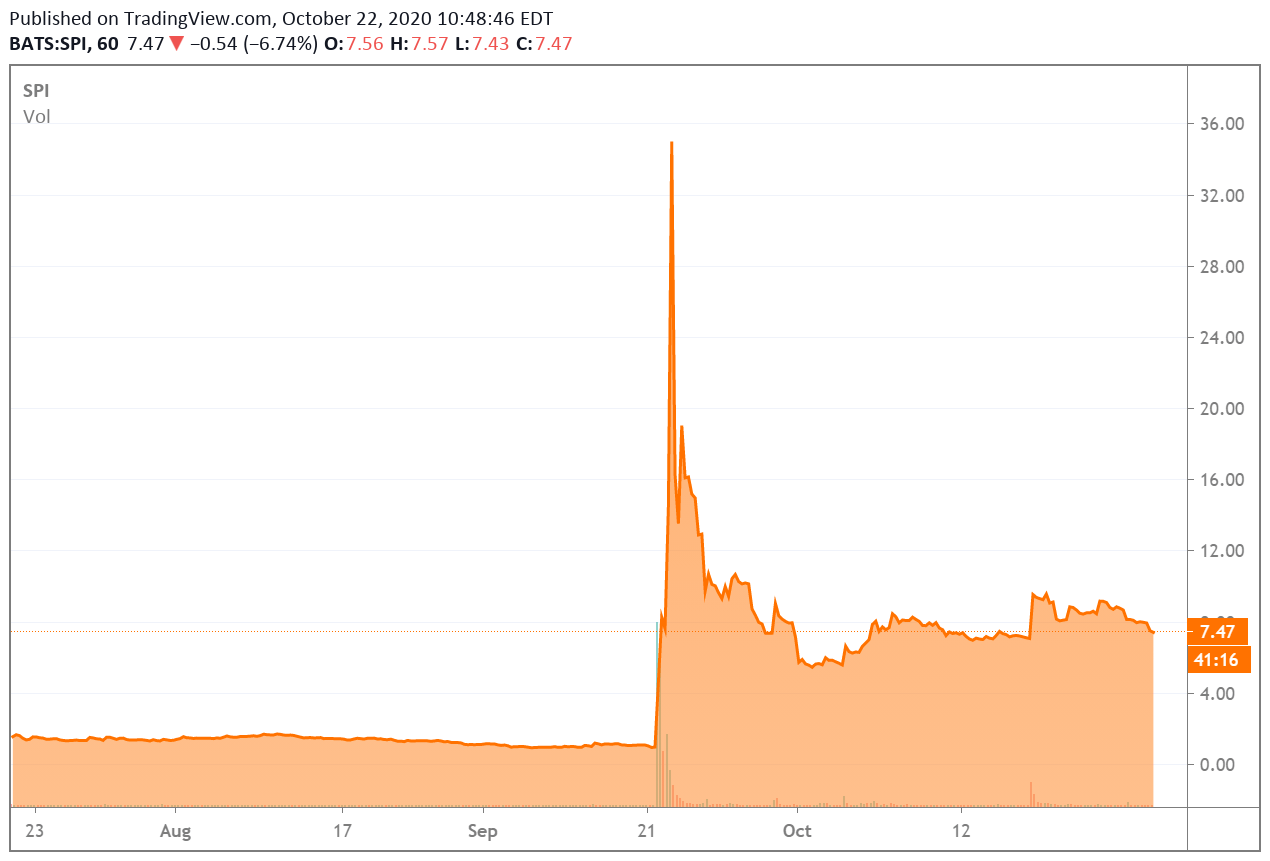

A common pump and dumping method in cryptocurrency is when fraudsters purchase a large amount of a low-cap cryptocurrency. This inevitably causes a big spike in the market and attracts naive investors who will "panic buy" the crypto out of FOMO. This further drives the price up.

Once the price is deemed to be peaking, the fraudsters dump their entire holding and take their profits.

The stock is generally promoted as "the next big thing" or a "hot tip" with guaranteed news announcing that the price of the stock will "skyrocket."

While pump and dumps schemes vary in detail, there is one particular concept at the root of everything: disrupting supply and demand.

Microcap cryptocurrencies are most susceptible to being affected by pump and dump scams.

Schemes may implement various other tools in a pump and dump scheme, including email spam, cold calling, and fake news releases.

Older Versions of Pump and Dump Schemes

With days passing by, fraudsters evolved and came up with unique ways to implement their illegal activities. They are as follows:

1. Classic Pump and Dump

Just like the name suggests, this move is as old as time.

Information on a company and its stock is manipulated.

This may include fake news releases, stock pitches over the telephone, and disbursement of a kind of "inside" information that holds the power to boost the stock price.

On top of that, dishonest stock promoters sell their services where they make way for the fraudsters to attract general investors' attention.

2. “Wrong Number”

This one is a brand new addition to the list of pump and dump schemes. Some people have reported receiving voice mails from strangers, claiming they have a “hot” investment tip for their friend.

The scammers want you to believe that the message wasn’t meant for you and was delivered accidentally.

But, the entire thing was a meticulous plan. Potential investors will be lured in, and the demand for the stock will rise.

3. Boiler room

A community meant to fraud.

A boiler room consists of a small brokerage firm with brokers employed with the sole purpose of using dishonest sales tactics to entice investors into buying questionable investments.

The brokers offer penny stocks, something the firm sells or purchases as a market maker through a cold call.

These brokers will give it their all to sell as many stocks as they can, which in turn boosts the stocks’ price.

After the price increases, the firm sells those shares to realize profits.

How to Avoid a Pump and Dump

As an investor, you need to be sensible enough to distinguish between an authentic stock that's expected to take off and something that's just blatant lies.

If the offers are unsolicited, that's an even bigger red flag. Consider the source and analyze said red flags.

Multiple notices will be sent from insiders or paid promoters who don't deserve your trust.

If the email or newsletter solely focuses on the "great things are coming" part and completely rules out the risks, it's possibly a scam.

Make sure to always conduct your own research on a stock before investing in it.

Final Thoughts

Remember the age-old saying that goes along the lines of, "If it's too good to be true, it probably is."

When someone you haven't been acquainted with offers you a stock tip, consider why they would share such information without you asking for it.

It's unlikely that you can make a quick and large return on investment, so think logically.

After having pump and dump explained, you should hopefully be able to steer clear of these scams.

Happy trading!

PS: We Love Your Comments!

Let us know your thoughts below...