Bull Flag Trading Strategy Explained

How to Effectively Trade Crypto Using the Bull Flag Strategy

June 17, 2021

Howdy Howdy!

Today we'll be learning about the bull flag pattern, how to identify it, and how to trade it effectively.

So without further ado, let's begin!

Bull Flag Definition

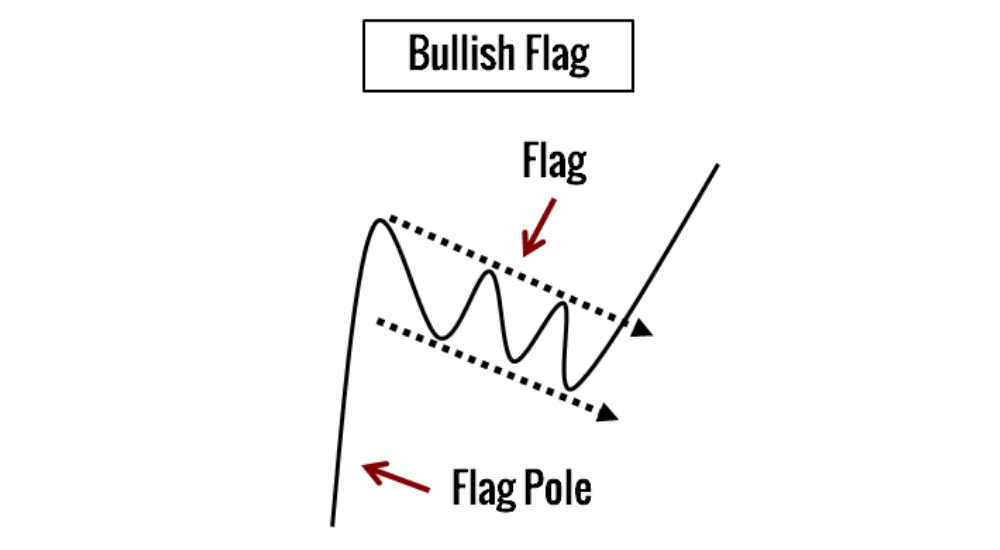

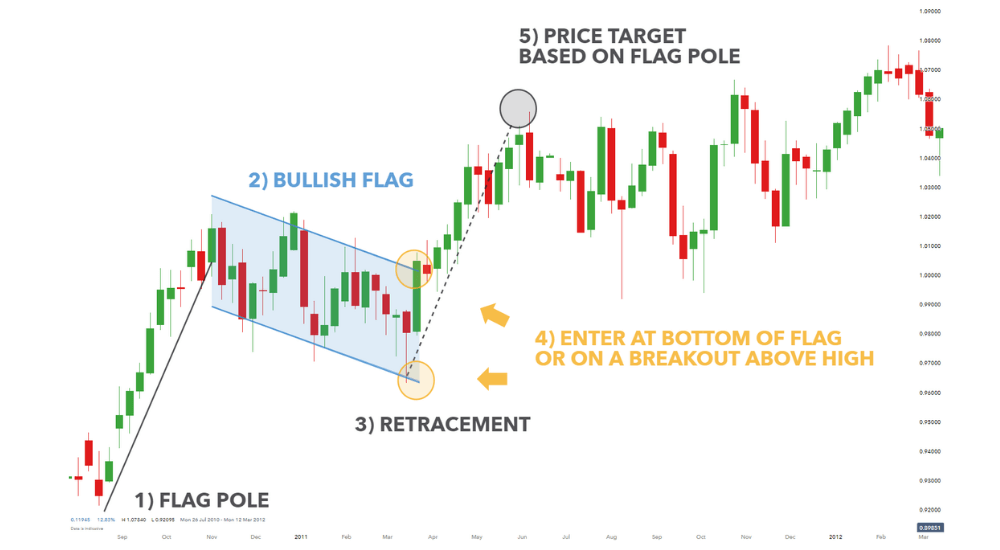

A Bull Flag is a bullish continuation pattern and is generally found in a strong uptrend. They are called Bull Flags because the initial vertical move upwards followed by a period of consolidation resembles a flag pole when looking at the trading chart.

Bull Flag Strategy Difficulty

Pros:

![]() Trading with Volume and Momentum

Trading with Volume and Momentum

![]() Very Easy to Spot

Very Easy to Spot

![]() Generally Have Large Profit Margins

Generally Have Large Profit Margins

Cons:

![]() Possibility of false breakouts

Possibility of false breakouts

What is the Bull Flag Strategy?

The bull flag strategy is a continuation pattern in the chart that denotes that the market will continue move higher and higher.

Experts have been monitoring this strategy for decades, and it leads to definite success.

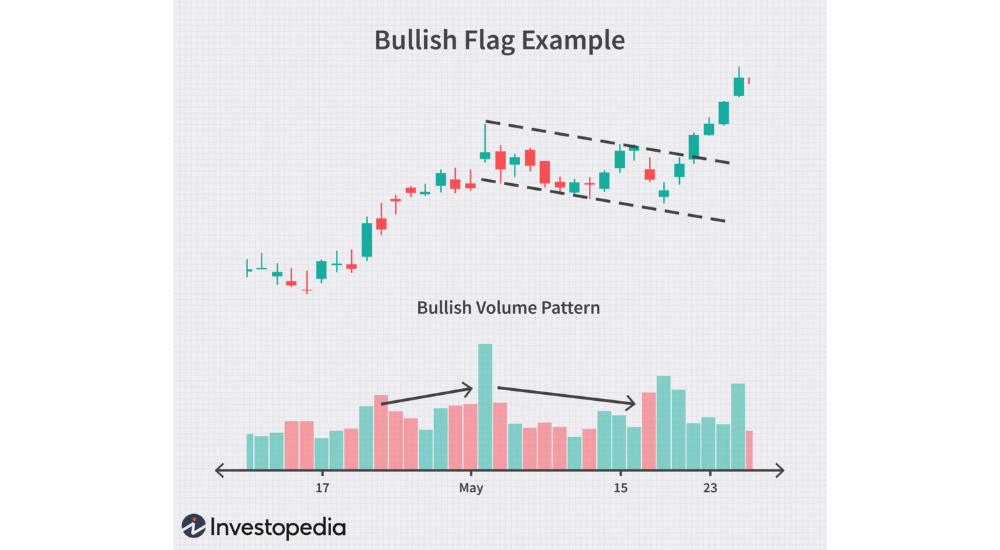

In this strategy, it seems that the volumes are moving upwards in a bullish manner.

Once the volume consolidates, it looks like a flag at the end of a pole. This is why it’s called a bull flag strategy.

Features of a Bull Flag:

There are certain features that you can spot in every bull flag out there. These are:

- There will be a significant rise in the high relative volumes, and this momentum will create a pole in the chart.

- The flag will be created when the high relative volume consolidates at the top of the pole. It’s important to remember that the candles will be smaller than the previous ones.

- The strategy will be broken, and stock will be on a high relative volume will be on the rise again.

How Do You Spot a Bull Flag?

Spotting a bull flag is the toughest step in the process, but this, too, is comparatively easier than the steps you find in any other process.

Then again, this will get much easier if you use scanners to spot stocks that are surging upwards in a bullish pattern.

One of the biggest mistakes people tend to make is that they decide without seeing the consolidation strategy.

Remember, only the upsurge isn’t enough to ascertain whether it’s a bull flag strategy or not.

If the price is not consolidated on a lower volume, you can’t make any move.

If you do so, you’ll be doing it at great risk.

Although it’s tough to find these on your own, you can use free scanners like Finviz to help you out if you're a beginner.

Although it’s tough to find these on your own, you can use free scanners like Finviz to help you out if you're a beginner.

If you’re set on finding the strategy by yourself, that’s better, in fact.

Scanners aren’t always accurate, and you can always spot patterns and formations better by yourself.

Bull Flag Signals

- Huge upsurge in the stock. The candles will rise in a short time, making them form a pole-like structure.

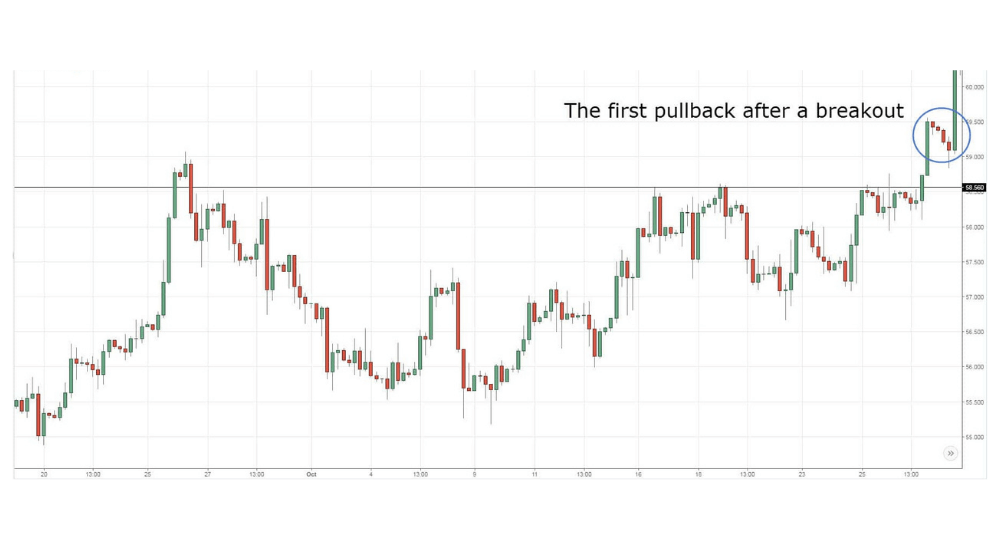

- The price will begin to consolidate. More often than not, will they consolidate near the highs. It’s important to look for pullback strategies that are well defined.

- Prices will break out of the consolidation point and rice even higher.

When To Apply the Bull Flag Strategy?

While there are people who may think that the right time to buy is when the volume rises to the peak of the flagpole, we beg to differ.

There will be almost zero to a minimum time before the prices begin to consolidate, and you won't have enough time to decide between buying.

Then what’s the best time to buy?

We tried out many different portions in the strategy, and we found in our research that the sweet spot is buying when the stocks break out of the consolidation, and the prices rise even higher than the flagpole, which they usually do.

Source: Dailyfx.com

This is the right time to buy as you can prepare yourself by spotting the bull flag strategy, and this is also the point that will offer the highest prices in most cases.

When placing the order, you must ensure a risk to profit ratio of 1:2.

This means, if you’re risking 50 cents for your entry price, then you must ensure that the profit will be at least 1 dollar.

Although the bull flag strategy is considered one of the most reliable strategies, it might not work out every time.

This is why you need to know how you can jump ship to minimize risk.

The first thing you need to determine is the stop below point. If the stocks dip lower than the consolidation point, it’s time to acknowledge that there’s no point in lingering around it, and you must accept some loss.

Then again, the 20-day moving average is also a great stop. If the prices settle below the moving average, you better close out to avoid further losses.

We have the bull flag strategy explained now, but we haven’t talked about some strategies that are always associated with the bull flag strategy.

Flat Top Breakout vs. Bull Flag Strategy Explained:

While in the bull flag strategy, the prices tend to consolidate below the highs, in the flat top breakout, the prices tend to consolidate within a few cents of the highs.

Bear Flag Strategy vs. Bull Flag Strategy Explained:

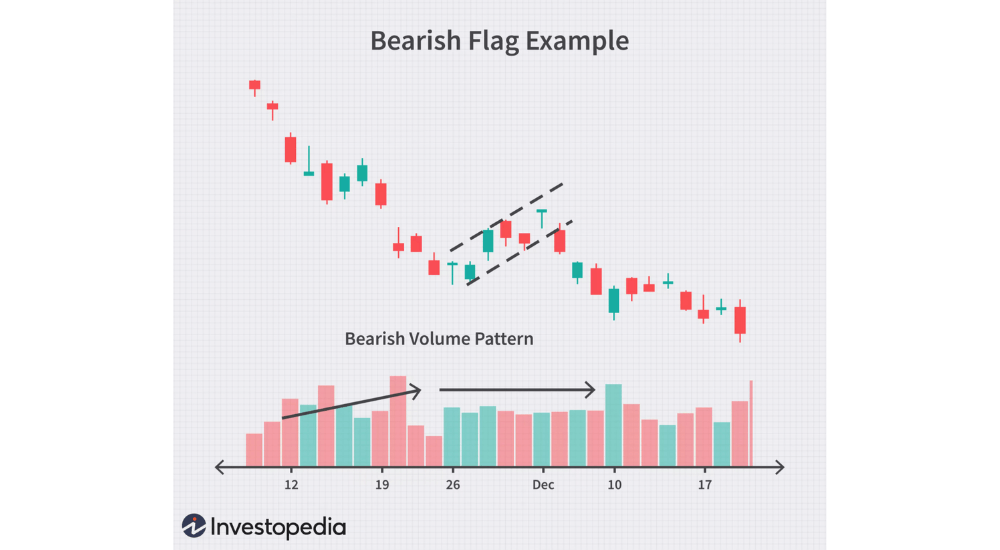

The bear flag strategy is just like the bull flag strategy. However, this strategy is completely the inverse of the bull flag strategy as it spirals downwards.

In the bear flag strategy, you’ll see that the prices plunge so quickly that they form a pole, then they tend to consolidate a bit higher than the rock bottom to create a flag-like shape.

After several pullbacks, there will be another critical dip, and the trend will continue.

Tips When Trading a Bull Flag Strategy

These are some important things to remember when learning to trade with the Bull Flag Strategy...

#1 Keep An Eye On Resistance

Resistance is the most important thing to look for in a bullish flag pattern. it's what prevents the stock from rising again.

You don't want to be too far ahead of the action.

Wait for the resistance line to form then watch the price break above that line before buying, if the breakout fails and falls below the resistance, don't wait, cut your losses and exit the trade!

#2 Always Use a Stop-Loss

Stop losses are the most important factor in any trading strategy, you need to know your entry and exit points before opening any trade.

It's important to never let a small loss turn into a great loss.

If you lose, you lose small.

#3 Follow Price Action

Always wait for price action to confirm the pattern.

By doing this you minimise the probability of trading into a false breakout, don't get ahead of yourself and always wait for confirmation.

Kraken - For Technical Crypto Trading

Kraken is one of the most traded exchanges in the crypto markets with extremely low trading fees of 0.05%-0.25%. The high volume and liquidity at Kraken means you can enter and exit trades quickly and capture margins instantly with slippage. Kraken is the best exchange for high-speed crypto trading!

Bull Flags in a Nutshell

Here you found the bull flag strategy explained, and now it’s time for you to implement your knowledge on this setup. While it’s a favourable setup for beginners, it too can go wrong at certain times.

So, it’s important to know when and how to pull out of it to minimize risk. If you keep the mentioned points in mind, hopefully, you’ll make a profit out of it.