Gap and Go Strategy Explained

A sound strategy is what differentiates a successful day trader from an unsuccessful one. Discipline is key if you want to realise profits. The Gap and Go strategy has proven to be one of the most effective ones in the market. If you’re curious about the tactic, you’ve arrived at the right place!

On today’s discussion of “Gap and Go explained" we'll breakdown the entire plan for you, bit by bit, so you can be completely familiarised with the basics of a gap.

What is a Gap?

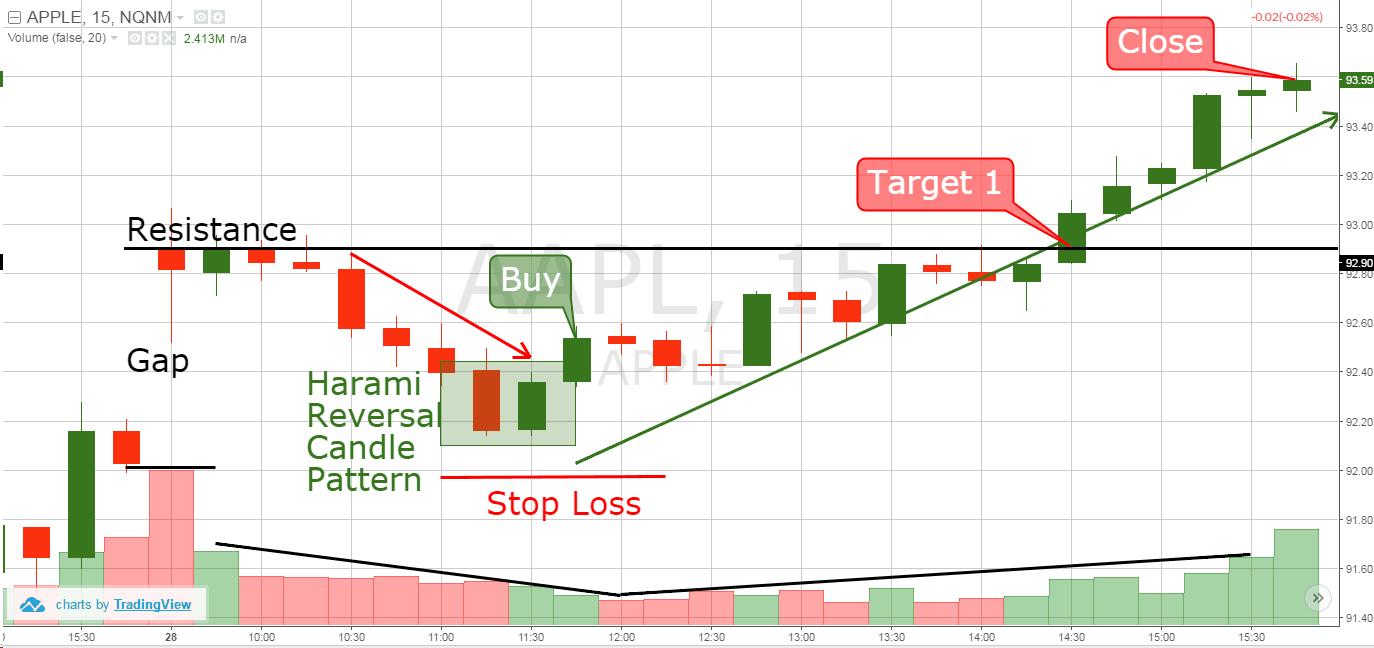

In the world of trading, even with little to no transactions occurring, there will be certain locations on the chart that will show a sharp movement of security prices, either in an upward or downward direction. This is termed as a "gap" on otherwise regular price patterns. A trader who's been in the market for a while will always be able to evaluate and exploit these gaps to earn profits and that's exactly what your goal should be with the Gap and Go strategy.

Keep in mind that gaps don't happen naturally. A bunch of underlying factors plays a role in the occurrence of this phenomenon. For instance, when a company earns more than what was expected of it, the company's stock value will experience a rise. This implies that when the market opens the next day, the price will start higher in comparison to what it was when the market closed the previous day.

Gap and Go Strategy: Explained

Experienced traders employ a method that utilises gaps occurring on a specific stock. As mentioned before, there are factors affecting the securities’ prices that propel the sudden rise and fall devoid of trading.

Gap Up and Gap Down: What Do These Stand For?

- When the price of a stock has a higher opening value than the former close, it’s a gap up.

- When the stock experiences a lower open than the previous close, it's a gap down.

- Scanners can be used to identify gaping stocks in the pre-market.

Everything to Know About Gap and Go Strategy

Oftentimes, a stock has little to zero premarket volume and showcases a gap up at the open. Many times gaps happen immediately at the open so it’s crucial to keep a decent gap and go scanner.

Many times, a news catalyst causes the stocks premarket volume. Occasionally, a stock may gap up without news on a market breakout.

Be extra careful in trading stocks that show gap ups without news catalysts. Yes, you can trade them but keep a proper trading risk management strategy in mind.

Indications of a Stock Gap Up

- It’s always great to use a stock scanner to know if the stock will gap up.

- Scan the pre-market every morning. You’re looking for stocks that display a minimum gap of 3%.

- Watch out for 100,000+ premarket volume.

- Filter and carefully observe any stocks with a news catalyst.

- Stocks with a news catalyst and premarket volume can be expected to gap up at the open.

- If a stock moves from red to green, that’s a sign that the move upward may continue. Pay attention to these red to green moves.

Dip buying is also popular among traders to minimise trading risks.

How to Trade the Gap and Go

Experienced traders are well versed in the skills to profit from gappers by implementing this strategy repeatedly and that is exactly why a new trader must learn this. Check out this list to know what you have to abide by:

Scanning every gapper showing 4% and more

Advanced traders rely heavily on their pre-market scanning tools. For example, Trade Ideas is a popular A.I.A, or Artificial Intelligent program playing numerous trading situations to traders. It memorises market relationships expected to have predicted outcomes. Additionally, it recognises what goes in a down or up market. Lastly, it recommends what a trader must buy or short, and when to exit.

Searching for Catalysts

Thanks to technology, traders from all across the globe with varying market conditions can trade. But it has also presented professionals with an opportunity to share their concepts on likewise platforms. On the hunt for news, PR, and earning reports, traders use services from social media platforms like Market Watch, StockTwits, and Benzinga. After a catalyst receives confirmation, looking for an entry is the next move.

Record the pre-market highs

Traders and investors typically monitor pre-market trading movements to analyse the direction and strength of the market. A normal trading session is anticipated. Premarket trading involves limited liquidity and volume, but traders get a great opportunity to make big bid-ask spreads. Experienced traders commonly begin pre-market access as early as 8 AM which is when the volume starts picking up. This applies to stocks with high or lower gaps based on news or rumours.

Prepare to purchase pre-market highs

In this stage, traders prepare to intend to place orders on pre-market highs. Experienced ones will go for easy and quick trades. The optimum time for these kinds of trades is from 9.30 AM to 10.00 AM EST. This is why profits can usually be counted by 10 AM.

Immediately buying high after the market opens

Right after trading starts at 9.30 AM EST, experienced traders will buy high right in the 1-minute opening range breakout (plus the stop at the low). They’re now going to take benefits from pre-market highs, earning them profit within 30 minutes.

Bottom Line

Although the primary point of the Gap and Go strategy is to realise profits, it's always a good decision to check out the low float stocks. There's quite some potential there and it's a good chance for the trading of the float once the market opens. It's important to remind yourself that, to find success with this strategy, trader interest, the correct catalyst, and float need to be present. That's gap and go explained – as simply as possible.