Day Trading, Swing Trading & Hodling: Which Is Best?

Day trading, swing trading, and Hodling, what's the difference?

You may have heard these terms used before, but what do they actually mean?

And most importantly, which strategy suits you as a trader?

In this article, I'll be going through each strategy's main characteristics as well as the pros and cons so you can decide for yourself which one suits you the best.

It's important to note that you are not exclusive to just doing one of these strategies; many people do all three.

Day Trading in Crypto

Day Trading is considered a full-time job and requires the most time and skill. This is by far the hardest of the three.

Most positions are only held for a few minutes or hours.

Day traders tend to favor technical analysis over fundamental analysis, using charts and indicators to predict the market's short-term movements instead of press releases and general background on the company.

Pros Of Day Trading

![]() Be Your Own Boss - As day trading is considered a full-time job, you set your own hours and workload.

Be Your Own Boss - As day trading is considered a full-time job, you set your own hours and workload.

![]() High-Profit Potential - The ability to capitalize on market trends can yield a great profit.

High-Profit Potential - The ability to capitalize on market trends can yield a great profit.

![]() Can Be Done Anywhere - All you need is a device and an internet connection, and you can work from anywhere in the world.

Can Be Done Anywhere - All you need is a device and an internet connection, and you can work from anywhere in the world.

Cons Of Day Trading

Can Be Stressful - Due to Altcoins' volatile nature, the price may fluctuate very quickly, which can become stressful at times.

Takes a Long Time To Master - Day trading is a skill that can take a long time to master and will cost you a lot with the mistakes you make in the process.

High Commission - By taking more trades, you pay more in commission.

The Truth About Day Trading in Crypto

Before you commit yourself to becoming a full-time crypto day trader, it's important to understand the reality of day trading cryptocurrencies.

Day trading in crypto is no joke.

Becoming a good day trader in normal financial markets is hard and requires a lot of time and dedication.

Becoming a consistently profitable crypto day trader is even more challenging because you have all the difficulties of regular day trading, such as technical analysis, risk management, trading psychology, and quick thinking, while adding in the fact that the crypto market has 10x the volatility of regular markets and is open 24/7.

So, If you aren't willing to put the effort into perfecting your trading strategies (which can take years), then day trading isn't for you.

It's challenging to become profitable, although once you get good at it, you will have a lifelong skill that will consistently make you money and give you the freedom that comes with being your own boss.

The truth: High risk, high reward, challenging and stressful skill to master with limitless upside once you perfect your strategy.

Next, we will be discussing crypto day trading vs swing trading to help you decide which is the best option for you.

Swing Trading in Crypto

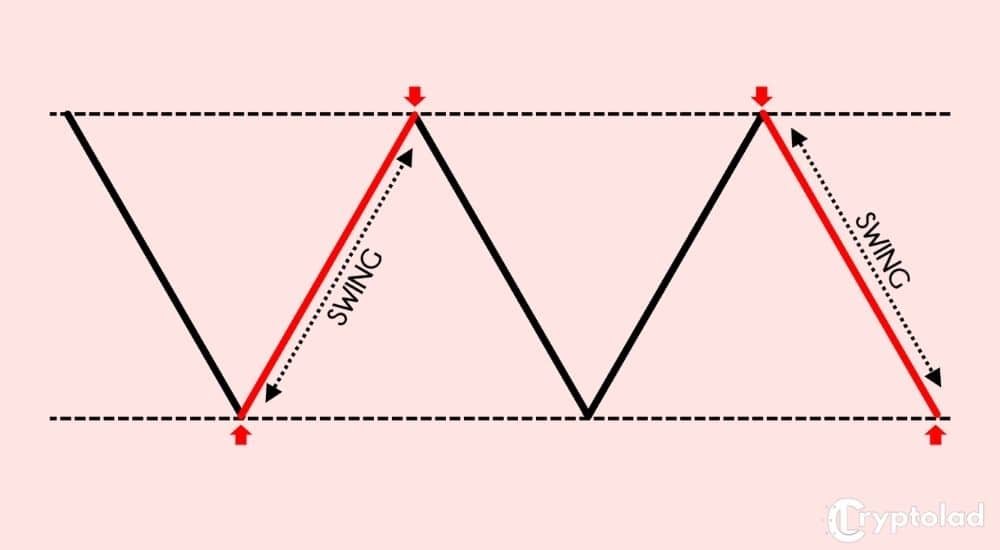

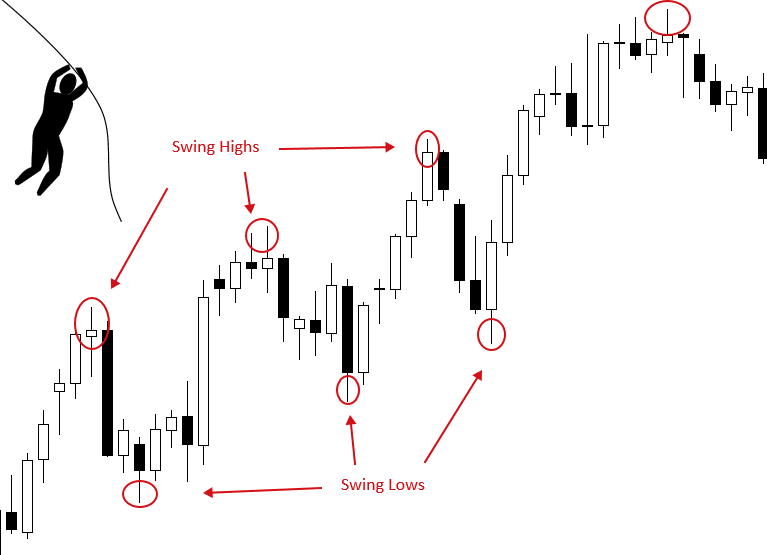

In the world of crypto, this trading method generally sees traders holding a position for days or weeks at a time and trading with each 'Swing' of the market.

When swing trading, you're looking to see some volatility in the market to profit from them.

Therefore you'll usually be trading mid-tier Altcoins.

Pros of Swing Trading

![]() Requires Less Time Than Day Trading - You can swing trade successfully with an hour or two per day, leaving you time to do other things.

Requires Less Time Than Day Trading - You can swing trade successfully with an hour or two per day, leaving you time to do other things.

![]() Using Technical Analysis - Technical analysis can be used to predict the flow of the price with good accuracy once you get good at it.

Using Technical Analysis - Technical analysis can be used to predict the flow of the price with good accuracy once you get good at it.

![]() Maximize Short Term Profit Potential - You're able to enter and exit the position once you see the market starting to turn.

Maximize Short Term Profit Potential - You're able to enter and exit the position once you see the market starting to turn.

Cons of Swing Trading

Riskier Than Hodling - Due to the volatile nature of Altcoins, you can lose money quickly if you aren't careful

Often Missing Long Term Opportunities - Swing traders often miss long-term opportunities favoring short-term market moves.

Benefits of Swing Trading

Active trading, in general, can be very stressful, depending on how you approach it.

Swing trading is, however, is very comfortable because you don't have to make immediate decisions.

You're trying to capture swings in the market, and these show up over days and weeks.

So, you have time to plan a trade, sleep on your analysis, develop a plan, and then execute it over some time.

Swing trading also minimizes screen time.

You can easily have a day job and a life outside of the markets without compromising activity.

You can do your homework when you come home from work. You can look at how the market moved and what stocks are setting up based on your strategy.

You can have the best of both worlds of being active and have great risk-adjusted returns, earn additional income, and all of the benefits mentioned before.

Swing Trading is the most common form of trading as traders can make decent profits while only trading for a few hours a day.

This works out well for people who have other commitments that take up a lot of their time.

Hodling

If you're new to the world of cryptocurrency then you're probably asking yourself what does HODL even mean? Let me explain.

In crypto, Hodling is a term you might hear quite often. Hodling is when you hold on to your coins for months or years without paying much attention to market volatility.

This is considered the least risky of the three since you'll mostly be trading larger, more established names with a stable price, such as Bitcoin, Ethereum, and XRP.

These coins may experience much less volatility than other, smaller coins.

These positions can often be held for months or even years at a time.

Pros of Hodling

![]() Low Risk - Price typically fluctuates much less

Low Risk - Price typically fluctuates much less

![]() Less Effort Involved - After researching and initial taking of position, you can let the investment grow for months or years without having to touch it again.

Less Effort Involved - After researching and initial taking of position, you can let the investment grow for months or years without having to touch it again.

![]() Not As Stressful - Due to its stability, Hodling tends to be far less stressful than other trading methods.

Not As Stressful - Due to its stability, Hodling tends to be far less stressful than other trading methods.

![]() Save On Commission - Trading long term means you'll only be taking a few positions every couple of months or so. A low frequency of trading means less commission paid

Save On Commission - Trading long term means you'll only be taking a few positions every couple of months or so. A low frequency of trading means less commission paid

Cons of Hodling

Funds Are Tied Up - Your funds will be tied up in a position for long periods of time, which could see you miss other investment opportunities.

Requires Patience - Hodling is no getting rich quick strategy. It may take months or years to start seeing a return on your investment.

Homework - In-depth study on the asset is required before taking a long term investment

Overall, Hodling can prove to be a great investment strategy considering you have patience and don't expect any miracles.

Think of Hodling as a savings account with a very high-interest rate.

Hodling has been the best strategy over the last few years, thanks to the ever-growing cryptocurrency adoption around the globe.

Which is your favorite trading strategy and why? Let us know in the comments!