Breakout Trading Guide: Cryptocurrency

The fundamentals of breakout trading in crypto

April 1, 2021

Howdy Howdy!

You may have heard the term 'breakout trading' thrown around here and there, but maybe you aren't exactly sure what it means... or maybe you're an experienced trader looking to sharpen your trading skillset, either way, you'll find exactly what you're looking for in this article.

I'm going to teach you the fundamentals of breakout trading in the cryptocurrency markets, and ill even add a few of my favorite breakout trading secrets that I've learned from personal mistakes/experience.

Let's get into it!

Breakout Trading Definition

Breakout trading is the act of capitalizing on price movement that occurs when the price of an asset 'breaks out' of the market's predefined support and resistance levels. When the price breaks the resistance, breakout traders will go long, when the price breaks through support, traders will take a short position.

Breakout Trading Difficulty

Pros:

![]() Trading with momentum in your favor

Trading with momentum in your favor

![]() Relatively easy to spot an upcoming breakout

Relatively easy to spot an upcoming breakout

Cons:

![]() Possibility of false breakouts

Possibility of false breakouts

What is Breakout Trading?

Breakout trading is a simple yet highly effective method of trading used by many traders across multiple markets.

Being able to spot an upcoming breakout can yield great profits and is an invaluable tool to have in your trading arsenal. If you're able to identify a breakout early enough, you can capture huge price movements.

Identifying A Breakout

Identifying a breakout is easier said than done, but once you understand which key indicators to look for, you will gradually get better at spotting breakouts and higher accuracy.

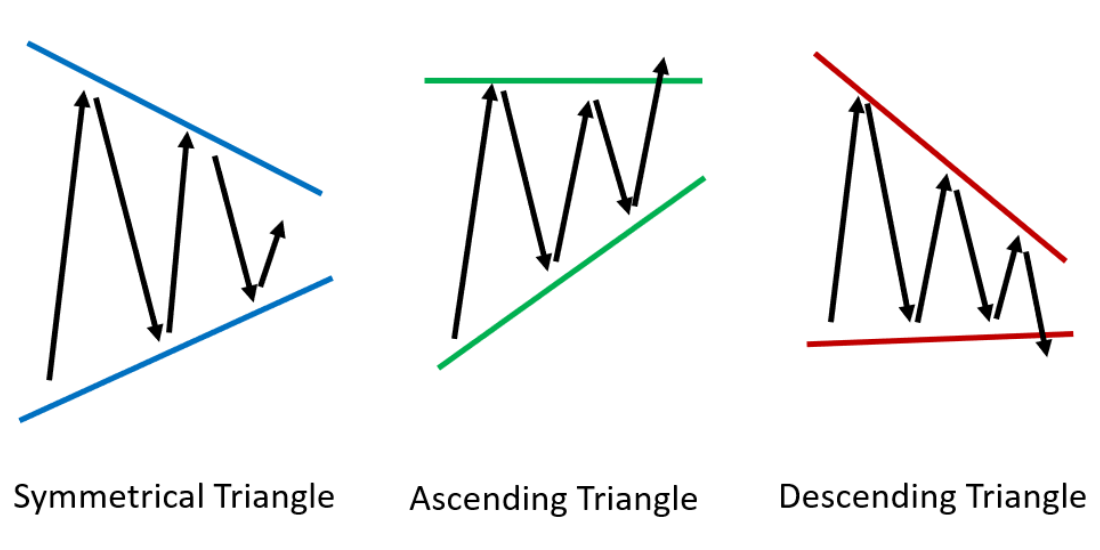

Breakout traders use chart patterns to identify when a breakout is about to occur, these include:

•Symmetrical triangle

•Ascending triangle

•Descending triangle

A price breakout will usually occur near or at the point where the support and resistance lines intersect, forcing the market in a certain direction.

•Symmetrical Triangle

The Symmetrical Triangle occurs when the price finds higher lows and lower highs and generally meets somewhere in the middle.

•Ascending Triangle

The Ascending Triangle pattern forms when the price is making higher lows into the resistance line.

•Descending Triangle

A Descending Triangle pattern is essentially the opposite of the Ascending Triangle. A Descending Triangle forms when the price is making lower highs into the support line.

Once a breakout occurs, the price will usually continue moving in the same direction with momentum.

Here's a great video going in-depth on how you can identify a breakout.

https://www.youtube.com/watch?v=bPnS9asAp_I

Things to Avoid When Trading a Breakout

Like all other trading strategies, being a successful breakout trader relies heavily on your ability to take multiple variables into account and form a decision based on probability and risk management.

With that said, when trading breakouts, there are a few things that will lower the probability of the trade turning out in your favor.

Here are the main things to avoid when trading breakouts.

•Trading into market structure

After identifying a breakout, it can be easy to assume that it's a great trading opportunity. However, it's essential always to be aware of the existing market structure, such as pre-existing support and resistance levels.

Why?

For example, all the indicators may be pointing in favor of a breakout. However, there may be pre-existing market structure just above or below the breakout point, which will usually cause a reversal and effectively neutralize the breakout.

•Big price movements

When breakout trading, it's important not to chase big price movements. If you see a massive spike in the price, it's generally already too late to make your trade.

Why?

- Following big price movements, the market is generally prone to a pullback.

- When the price breaks out of the current market structure, there's no logical place to put your stop loss.

https://www.youtube.com/watch?v=xTd6nlbcIZc

Trading a Breakout Successfully

Now that we've covered the things you need to avoid, let's have a look at what a good breakout setup looks like, step by step:

- Identify an upcoming breakout by using chart patterns and technical analysis.

- Analyze the build-up, the tighter the market is consolidating, the better. This provides a nice and close reference for your stop loss.

- Check the market structure, make sure the price isn't going to breakout into a support or resistance area.

- Decide where you're going to place your stop loss and calculate profit margins.

- Re-check that the asset isn't breakout out into the market structure

- Take trade

The best breakout trades are those with a clear path and no opposing pressure. (no market structure or areas of value).

Secret Sauce

The longer the price is in range, the bigger it breaks out.

Why?

It's not some supernatural phenomenon as to why this happens.

It's simply the accumulation of stop and buy orders over an extended period of time. Think about it, if the price has been trading within a range for a certain amount of time, it's very easy to determine the areas of value.

Therefore, many other traders will have placed their orders just outside the area of value. And as time goes on, more and more orders have accumulated. So when the price does breakout finally, it has a huge amount of orders ready to push the price in a certain direction.

Binance - The worlds largest crypto exchange

Binance has the very best volume out of all cryptocurrency exchanges, additionally, they also offer extremely low trading fees at 0.05%-0.1%. The high volume and liquidity at Binance means you'll be able to be in and out of trades within seconds which is crucial as a crypto trade

The Truth About Breakout Trading in Cryptocurrency

Trading breakouts in the cryptocurrency market is probably one of the most exciting ways of trading. Due to the volatile nature of the cryptocurrency markets, It's relatively easy to identify a breakout with huge profit potential.

You'll need to make sure you avoid false breakouts and trading into the market structure, as mentioned above.

Happy trading!