What is Kava Cryptocurrency?

Kava is one of the most exciting DeFi projects in the ever-expanding world of cryptocurrency.

So what is Kava and what can it do?

Kava is a cross-chain platform that enables users to stake, lend and swap with other cryptocurrencies.

Let's take a closer look...

What is Kava?

Kava is a game-changer in the cryptocurrency world seeking to solve its flexibility issue.

The crypto-coin offers lending strategies to its users and so much more.

It's designed to ensure an easy transition from bank loans and other fiat financial options to a friendlier crypto option.

Not to mention Kava is one of the pioneers of DeFi technology.

Most of its products are in the form of stable coins and collateralized loans.

Kava is a cross-chain platform that works almost as similar as the Maker DAO.

The slight difference is that the Maker supports the ETH and ERC-20.

On the other hand, Kava can provide collateralized debts on any cryptocurrency.

So far, Kava has garnered support from some of the big players in the crypto-world, including Ripple, Cosmos, and some hedge funds, for instance, Arrington Capital.

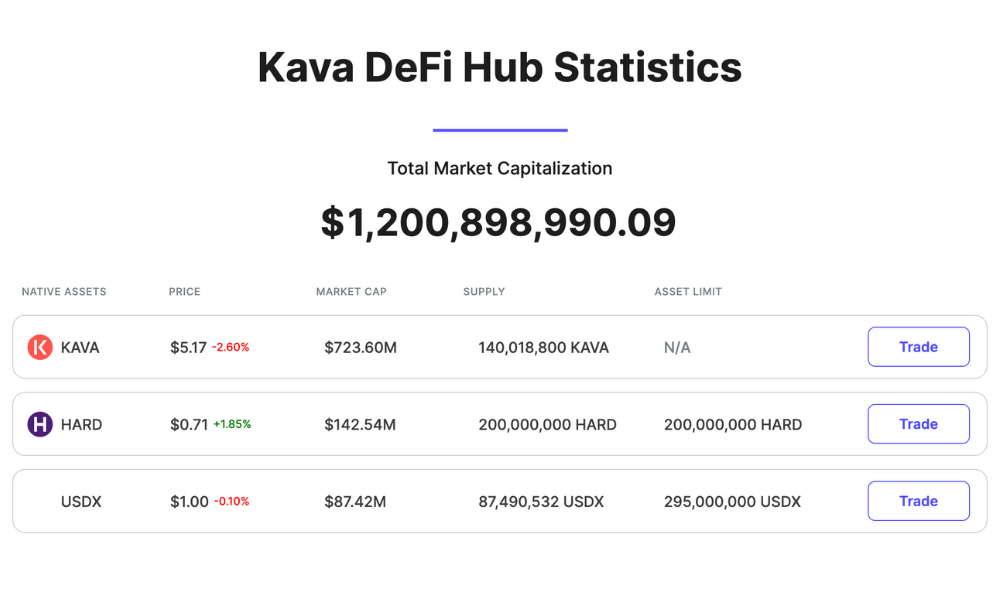

Kava uses USDX and Kava tokens to ensure its customers are well served.

The most exciting thing about using a stable coin is that the services will not be affected by inflation in the market.

Kava's Main Features

Cosmos Modularity

As I said earlier, the Kava cryptocurrency is based on the Cosmos open-source blockchain code.

That's the fourth-generation blockchain with futuristic tech that categorizes and leverages the blockchain market.

To be more specific, the Kava cryptocurrency is built on the Cosmos-SDK.

With this ecosystem, Kava can quickly implement any desirable modules, for instance, the IBC (Inter-Blockchain Communication.)

Proof of Stake

The Kava cryptocurrency implements the Proof-of-Stake consensus under the Tendermint protocol.

This improved PoS uses the BFT engine (Byzantine Fault Tolerant).

What that means is that this consensus is far more effective than some of the early blockchains, including Ethereum and bitcoin.

In more ways than one, this network is similar to the MakerDAO.

However, Kava's advantage is that it leverages the Cosmos to add more cryptos to their network.

We all know the advantage that PoS brings to the table compared to the PoW, especially scalability and efficiency.

That is why Ethereum 2.0 will incorporate the PoS consensus if it hasn't already.

That should solve the scalability issue on the Ethereum blockchain giving developers a chance to expand on their ideas.

And with the Kava cryptocurrency giving users financial freedom, you can now take your project to the next level.

Interoperability

One of the most impressive features about Kava, well, at least to us, is its interoperability.

What does that mean?

That essentially means that Kava is interoperable with other blockchains and still maintains its security.

Typically, Kava is the first of its kind, DeFi, to be launched on the Cosmos network.

What's more, this blockchain introduces a new feature that should catapult the DeFi feature to the next level, interoperability.

Multi-Collateral Options

The biggest DeFi challenge that most users have experienced is that most of them are based on the Ethereum blockchain.

Therefore, these platforms will only offer Ethereum coins after you've collateralized your assets.

Thankfully, Kava's vision is to provide open access to liquidity in a decentralized way.

That's all done by granting its users open access to crypto-loans in the form of a stable coin, USDX.

In short, Kava is extending the DeFi features that Ethereum is currently enjoying and bringing them to other blockchains in the market.

All you have to do to get access to the USDX is send your crypto-collateral to the Kava cryptocurrency, and they will be escrowed with smart contracts.

The USDX value is determined and rewarded to your account using the oracle system.

That's just a fancy way of saying the platform will determine your cryptos' value by checking the average market price.

That means they will use different price values on several exchanges to determine the average price then give you an equal amount of USDX.

How the Kava Blockchain Works

The Kava cryptocurrency is built with the same technology as Binance, Cosmos, and Tendermint.

However, the Kava network is different from Binance because it's multi-asset-based, and the entire network was created from the ground up.

Users in the network are awarded USDX as loans to their crypto-collateral.

Therefore, you will need to use your cryptos as collateral to get loans from this platform.

More importantly, users lock up their crypto assets in smart contracts on the platform to access the loans.

That will serve as the collateral.

With that in mind, you can use Kava to gain a leveraged advantage in the market.

For instance, you can submit your bitcoins as collateral on Kava.

Then you will instantly get a fresh batch of newly minted USDX.

The USDX can be used to purchase more bitcoins. That should give you an upper hand in the market.

You could also use this process to mint USDX.

Staking on Kava

Let's face it, and Kava staking rewards are still low compared to other cryptocurrencies in the market.

So, why would you bother staking it?

There are several reasons why I think you should try out this token.

For starters, Kava has insane amounts of inflations.

That means anyone who stakes gets the inflation rewards, and anyone who doesn't will endure the inflation taxes.

In simple terms, non-stakers of Kava will see their Kava tokens shrink as an effect of the circulating supply.

Therefore, if you'd like to gain from the Kava ecosystem, it's best to go with the staking choice.

More importantly, anyone who takes a loan from this ecosystem must pay a stability fee.

Once the payment is made, the equivalent Kava coin will be burned.

That's a deflation procedure that increases the pressure of staking rewards.

Thanks to its interoperability, Kava can virtually add any crypto-coin or asset as collateral.

Why is USDX Used in Kava?

You are probably wondering why this ecosystem chose to go with USDX as their go-to stable coin while there are hundreds of stable coins out there.

Well, from my perspective, this might be the only somewhat 'decentralized' and transparent coin out there.

What do I mean by that?

well, unlike most centralized-fiat cryptocurrencies, USDX is fully transparent, and you can see what exactly is backing up the crypto, collateralized loans.

There's no need for any trust issues. What's more, this coin is decentralized, and it uses the Kava network.

That means it's impossible to shut down the crypto than other centralized, stable crypto-coins such as Tether.

The blockchain is spread out across the world in several nodes.

Additionally, USDX can be bonded, and you will receive interest in your token.

You will get an interest of about 4% per annum, which is essentially a lot compared to most stable coins.

Thankfully, you don't have to worry about the market swings since, well, USDX is stable.

Kava Tokens Explained

Kava Tokens is the staking coin on the platform, and it works essentially the same way as Maker on MakerDAO.

Some of the crucial features of this coin include:

Governance

The token holders can participate actively in the blockchain's operations and vote to make any adjustments.

That includes collateral date ratios, supported collateral types, and others. Amazing, right?

Well, that's not all! You are not entirely obligated to participate in the governance of the blockchain.

That's because you can also delegate your rights to voting to the validators who secure the ecosystem as well.

If you want to check out the highest Kava validators, you can look at mintscan.io.

Last resort insurance

Kava works as the final resort lender when there's an over-collateralization of USDX.

Yes, that's right! In cases where the USDX coin is over-collateralized, the blockchain will start minting new Kava coins to be used in the purchases of USDX.

Therefore, this token oversees the ecosystem's survival and acts as insurance during challenging times.

More importantly, through the Kava coin, USDX can maintain its stable coin state even when the market swings.

Staking

when it comes to staking rewards, Kava is currently giving hodlers an interest of about 5.5% annually.

Yes, it's not one of the highest staking rewards in the market, but it's not too shabby either.

However, the staking reward will vary depending on the number of holders out there.

The fewer people are staking, the more beneficial it will be.

With that in mind, the staking reward will fluctuate from 3% to around 20%, depending on the stakers.

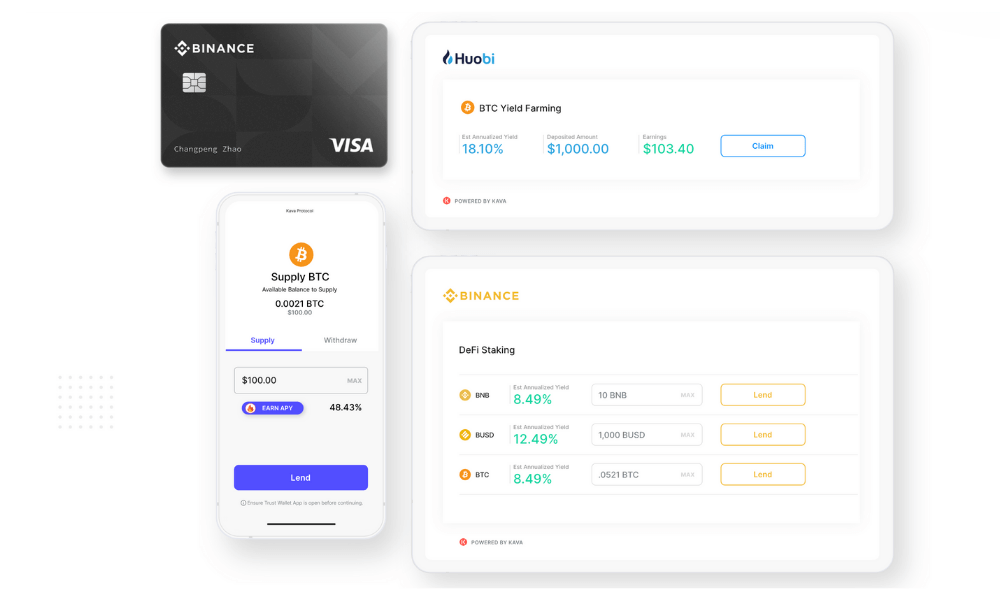

How to Buy Kava Coins

The easiest and most effective way to get Kava Coins is through Binance. All you have to do is create an account on Binance, and you are good to go.

Other crypto-exchanges that will grant you the chance to trade on Kava include Kraken and Huobi.

You can also take advantage of the Kava network's financing options, including the crypto-loans and the minting of USDX.

That should give you an upper hand in trades while also ensuring your coins' security.

Thankfully, on Kava, even when your collateral has been auctioned, you can still get it back by paying up the debt and the fees.

Kava in a Nutshell

DeFi is a new realm that most crypto-developers are trying to explore.

Above all, DeFi evidently will lead to the mass adoption of cryptocurrencies.

That's because crypto-traders and enthusiasts will get access to 'Bank-like' financial options that could only be, otherwise, attained by the 'wealthy.'

This is what Kava is trying to accomplish.

The best part is that Kava has cemented other assets' collateralization, not just ETH, like its counterparts.

Imagine for a second what that means to the crypto-world?

Typically, through Kava, you can collateralize anything with a value-price in it. Yes, you heard that right!

You could even collateralize commodities such as Gold or even Oil!

But of course, we still have a long way to go before actualizing such events.

However, Kava is taking broad steps in the right direction, and soon, most developers will take advantage of this opportunity.

This blockchain could very well prove to be a formidable opponent giving most of the major cryptocurrencies a run for their money I can't wait to see what happens next for this coin and what they have to offer to the crypto-community at large.