Scalp Trading in Crypto: Read This First

March 23, 2021

So you've probably heard the term 'Scalp trading' used a few times but aren't too sure what it means.

In this article, I will be explaining exactly what scalp trading is and what it takes to be a profitable scalp trader in the cryptocurrency markets.

Let's get started...

Scalp Trading Definition

Scalp trading is a form of high-frequency trading where traders aim to make small incremental gains that add up over time. Scalp traders usually trade on the 1-3 minute charts, often only holding positions for seconds or a few minutes at a time.

Scalp Trading Difficulty

Pros:

![]() High profit potential

High profit potential

![]() Constant incremental profits

Constant incremental profits

![]() Trading fewer markets

Trading fewer markets

Cons:

![]() A high level of trading skill required

A high level of trading skill required

![]() Very fast-paced

Very fast-paced

![]() Time consuming

Time consuming

What is Scalping?

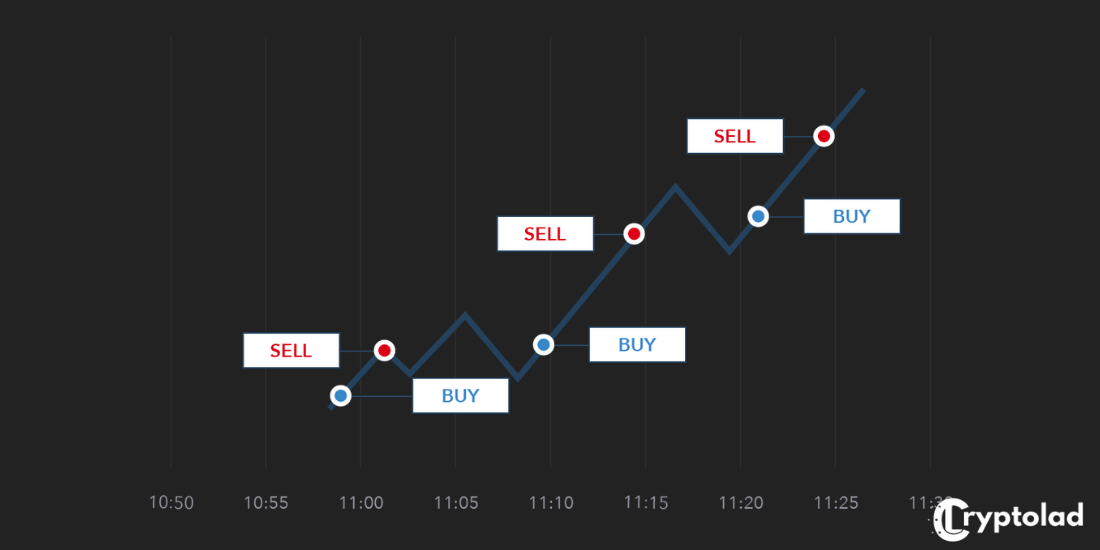

Scalping is basically a trading technique that revolves around traders trying to profit off small price movements.

Scalp traders in the crypto markets don’t aim for making huge profit margins, what they do instead is look for small gains from slight changes in the prices of cryptocurrency coins.

They look for small market discrepancies, inefficiencies, and other price fluctuations over a small time-frame and buy or sell in that period multiple times to ‘scalp’ profits.

Stacking and compounding these small gains over an extended period can help traders make significant profits.

Because of the short time slots used in scalp trading, scalpers, as they’re called, heavily rely on techniques and tools like technical analysis to propel their trading efforts.

They don’t use fundamental analysis to make decisions as those analysis techniques are for long-term gains.

Scalpers in the cryptocurrency markets require more in-depth market knowledge since information about the crypto market is scarce and not as widespread as that involved in stock markets.

Who Should Scalp Trade in Cryptocurrency?

It's important to note that scalp trading is not for everyone, and that's perfectly fine, there are many different types of trading, and you need to choose the right style to suit your lifestyle.

Here are a few characteristics of a successful scalp trader:

•Quick decision-making

Scalp trading is very fast-paced. As a scalp trader, you'll typically be in and out of trades within a few minutes. Therefore, you need to be able to make quick decisions with high accuracy.

•High level of trading knowledge

A successful scalp trader will know how to read charts, identify patterns, trade multiple strategies depending on current market conditions, and know how to manage risk. With that said, scalp trading is not for beginners.

•Uninterupted schedules

It's not uncommon for scalp traders to be watching their monitors for up to 12 hours a day. Therefore it's extremely time-consuming and best suited to someone who doesn't have many real-world distractions.

How to be a Successful Scalp Trader in Crypto

If you've read the previous section and still want to be a scalp trader, congratulations!

Now I'll give you a few important tips on how to be a profitable scalper in crypto:

•Know Your Market

As a scalp trader, you'll be trading 2-3 markets at most. This is because you need to understand your market deeply.

Whether you decide to scalp trade Bitcoin or scalp trade the Ethereum market, you need to know exactly how the markets act in certain situations.

Every market behaves differently, and you need to understand exactly how your specific market behaves. For example, a profitable scalp trader will know which times of the day their market sees the highest volatility, how it reacts after a breakout, how long the market typically trades within a range before breaking out.

You need to understand exactly how your market behaves in order to make accurate snap decisions.

•Be Fluent With Your Strategies

As mentioned above, you'll be trading 3 markets at the most. Therefore you cant just trade on breakouts or trade on reversals, you simply won't make enough trades to profit from.

Here are the 10 most common candlestick patterns that will help you with scalping.

You need to know how to trade all strategies depending on what the market is doing. A successful scalp trader is able to identify multiple upcoming patterns and know exactly how to trade with them.

•Protect Your Profits

Risk management is one of the biggest factors in becoming a profitable scalp trader. As your profit margins are quite small on a trade-to-trade basis, a small miscalculation can quickly eat into your profit.

You'll need to take the spread and trading fees into account whenever calculating each trade's entry and exit points.

Take profits at certain points in each trade, sell a % of your position to lock in profits while you let a winner run. By doing this, you are guaranteeing a profit while getting the most from your successful trade.

•Visualise Possible Outcomes

By visualizing possible outcomes and planning how you will react to each individual outcome you can make clearer and more decisive decisions in real-time.

Try to visualize what the market might do ahead of time and visualize your reaction to these possible outcomes.

So if you're scalp trading bitcoin for instance, what will you do if the price breaks out with momentum in a favorable direction? You might visualize letting the trade run while locking in profits at certain pre-determined price points.

While scalp trading, time means money, the quicker you can make a decision the more profit you can lock-in.

Common Indicators Used By Scalpers

With a comprehensive study into market terms, you can determine the best time in the crypto market to indulge in a scalp trading strategy. Here are a few common indicators that scalpers will use to read the market.

Relative Strength Index (RSI):

The RSI is a way to indicate momentum after analyzing recent changes in prices. It determines whether an asset inside a crypto market, say Litecoin, is sold or bought at an extensive rate and plots it as a single line graph.

Like other indexes, it has a relative value that ranges from 0 to 100. The higher an RSI, the greater are the chances of an asset having an overvalue or experiencing an overbuying trend.

The threshold for overvaluing an asset is a 70 or more RSI score indicating selling trends. In contrast, an RSI below thirty indicates that the asset is primed for the price hike, is undervalued, and therefore, shows that it’s a good time to invest in it.

Support and Resistance Levels:

The support and resistance levels of a particular asset vary with an increase or decrease in price. So it’s a good idea to keep an eye on this.

Moving Averages:

Moving averages help traders determine where the price is projected to head in the future using past data, trade automation software, and modeling features.

Best Crypto Exchanges for Scalp Trading

There are a few things you need to look at when choosing an exchange for scalp trading.

•Low Spreads - This is the difference between the buy and sell price, lower spreads = bigger profit margin

•High Liquidity - High liquidity will allow you to enter and exit trades quickly, which is extremely important for a scalp trader

•Low Fees - This goes without saying, but as you're going to be trading on a high frequency, trading fees are definitely a big factor when choosing an exchange to scalp trade on

With these above factors in mind, we'd have to recommend Binance and CEX.IO. These exchanges have high liquidity, low fees, and low spreads and would be ideal for scalp traders.

Binance - The worlds largest crypto exchange

Binance has the highest volume out of all cryptocurrency exchanges, in addition, they also offer the lowest trading fees at 0.05%-0.1%. The high volume and liquidity at Binance means you can be in and out of trades within seconds which is crucial as a scalp trader.

CEX.IO - Unparalleled level of security

CEX.IO is one of the most secure exchanges on the market. They take the security of their customer's funds and data very seriously. They also have high liquidity with some of the lowest fees in the market at 0.26%.

The Truth About Scalp Trading in Cryptocurrency

Scalping in cryptocurrency can be rewarding yet very challenging. It's going to take a lot of practice to become profitable and isn't something you're going to learn overnight. If you're new to trading in general, I would not recommend scalp trading just yet. Instead, it would be best if you practiced on higher timeframes in order to give yourself more time to develop your skills.

With that said, I hope you enjoyed the article and if you have any further questions, feel free to comment below, and I'll be sure to answer.

Happy trading!

New to Cryptocurrency? Read our free beginner guide!

Image by IG.com

Image by IG.com